Associated Builders and Contractors (ABC) Construction Backlog Indicator (CBI) reached a new all-time high during the third quarter of 2014 at 8.8 months, eclipsing the previous all-time high of 8.5 months in the second quarter of 2014. The 2014 third quarter backlog is 6.9 percent higher than the third quarter of 2013 and the continued growth of backlog during the last six months likely indicates that 2015 will be a strong year of recovery for the nation's nonresidential construction industry.

"Every region of the nation experienced expanding backlog during the third quarter and so did every industry segment," said ABC Chief Economist Anirban Basu. "Recent data regarding nonresidential construction and employment has shown only sporadic gains, which is consistent with the less optimistic backlog readings registered earlier this year. But the last two quarters tell a positive story that the average nonresidential contractor in America is positioned to get busier.

"Given the recent acceleration in job growth, the improvement in the quality of jobs being added, and a still-accommodative Federal Reserve, the U.S. macroeconomic outlook for 2015 represents the most upbeat assessment of economic prospects during the post-recession period," said Basu. "The nation has added more than 2.6 million jobs over the past 12 months and, for the first time in six years, the nation's unemployment rate has dipped below 6 percent. While there are a number of headwinds, including a still-shaky global economy and a meaningful dip in oil prices that is likely to impact both oil production and related capital spending, most leading indicators remain positive. Lending conditions appear to be easing and a booming stock market has generated both positive wealth and confidence effects."

Regional highlights

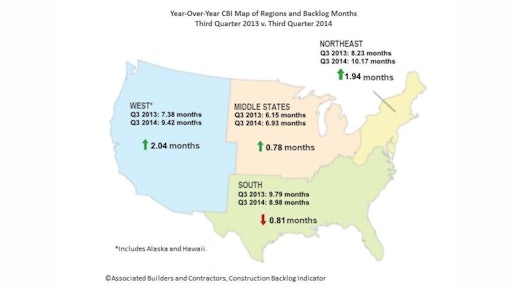

Average backlog increased in all regions. The technology boom in Boston’s suburbs, the positive impacts of Marcellus Shale-derived activities and a resurgent Wall Street are all contributing. A recent uptick in subcontractor failure may also be contributing to rising backlog among industry survivors. Backlog remains lowest in the Middle States, in part because of still-sluggish conditions in Illinois. However, conditions continue to improve in Ohio and Michigan.

- Average backlog is up by nearly two full months in the Northeast over the past year and by more than two months in the West. This is consistent with a rapid rebound in many East and West Coast communities that previously were held back by the housing and financial crisis of several years ago.

- Average backlog is at or nearly at a record high in three regions, the Northeast, Middle States, and the West.

- Backlog in the South has not progressed over the past year, but is positioned to expand due to the recent acceleration of economic growth in Louisiana, Georgia, Florida, Texas, and a number of other states.

Industry highlights

Backlog expanded among all industry segments during the third quarter and all categories have also experienced year-over-year increases. Surprisingly, average backlog climbed most profoundly during the past quarter in the infrastructure category. A number of states, including Maryland, have significantly increased tolls and taxes in order to fund transportation infrastructure, which may be supporting lengthier backlog. Backlog also climbed meaningfully in the heavy industrial category, which is consistent with the recent resurgence of industrial production as well as the ongoing expansion of energy production and distribution-related investment.

- Based on recent CBI readings, investment in the nation's industrial sector should be significant in 2015. Once beholden to foreign energy producers, America is now on the verge of becoming the world's leading oil producer and is already its preeminent provider of natural gas. This is contributing to a significant uptick in investment in the nation's factories and distribution facilities.

- Consumer spending remains strong and the professional services sector is adding more jobs than any segment of the economy. Not surprisingly, average backlog in the commercial segment remains at a lofty level.

- Rebounding state and local government budgets may help keep backlog rising in the infrastructure segment despite ongoing gridlock at the federal level.

Highlights by company size

The nonresidential construction recovery has now begun to encompass smaller firms. The third quarter of 2014 represents the first time firms with annual revenues below $30 million have reported average backlog above eight months in the history of the CBI series. At 8.25 months, the small firm CBI is now nearly a month longer than it was one year ago. Large firms continue to report the lengthiest backlog, which comes as little surprise since these firms are most closely associated with the largest projects. Average backlog slipped a bit for firms between $30 million and $100 million in annual revenue, perhaps because larger firms have become increasingly willing to bid on smaller projects.

- Less than five years ago, firms with annual revenues below $30 million were collectively reporting an average backlog below five months. Over the course of time, backlog has ratcheted higher among this group to reach 8.25 months in the third quarter of 2014, the highest level recorded since the inception of this series.

- Large firms remain busy, with backlog remaining at or above 9.99 months for nine consecutive quarters. Given the large number of industrial and energy-related projects now in planning stages, particularly in the South, large firms are likely to see average backlog rising over the next year.

- Backlog in the category comprised of firms earning revenues between $50 million and $100 million per annum dipped below 10 months for the first time in six quarters during the third quarter of 2014. However, it remains well above average backlog levels of four years ago when the on-again/off-again nonresidential construction recovery was just beginning to take shape.