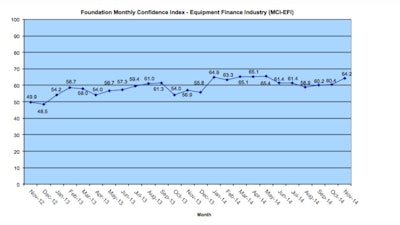

The Equipment Leasing & Finance Foundation's (the Foundation) November 2014 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI)is reporting overall confidence in the equipment finance market is 64.2, an increase from the October index of 60.4 and the highest level since May. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $903 billion equipment finance sector.

“The mid-term elections are now over, and consumer confidence seems to be improving as gas prices and unemployment statistics continue to decrease," said survey respondent Valerie Hayes Jester, President, Brandywine Capital Associates, Inc. "We have experienced an increase in demand for capital equipment purchases and, more importantly, financing for those orders. Another important note is that the equipment being requisitioned appears to be associated with business expansion and not just replacement of older assets.”

November 2014 survey results

When asked to assess their business conditions over the next four months:

- 27.3% believe business conditions will improve, up from 23% in October

- 69.7% believe business conditions will remain the same, down from 74% in October

- 3% believe business conditions will worsen, unchanged from the previous month

- 30.3% believe demand for leases and loans to fund capital expenditures (capex) will increase, up from 25.7% in October

- 66.7% believe demand will “remain the same”, down from 71.4% the previous month

- 3% believe demand will decline, unchanged from October

- 21.2% expect more access to capital to fund equipment acquisitions, up from 11.4% in October

- 78.8% expect the “same” access to capital to fund business, down from 88.6% in October

- None expect “less” access to capital, unchanged from the previous month

- 45.4% eexpect to hire more employees, an increase from 40% in October

- 48.5% expect no change in headcount, unchanged from last month

- 6.1% expect fewer employees, down from 11.4% in October

- 3% evaluate the current U.S. economy as “excellent,” unchanged from last month

- 97% evaluate the current U.S. economy as “fair,” up from 94.3% in October

- None rate it as “poor,” down from 3% the previous month

When asked to assess conditions over the next six months:

- 42.4% believe that U.S. economic conditions will get “better”, an increase from 28.6% who believed so in October

- 54.6% believe the U.S. economy will “stay the same”, down from 68.6% in October

- 3% believe economic conditions in the U.S. will worsen, unchanged from last month

- 42.4% believe their company will increase spending on business development activities, an increase from 34.3% in October

- 54.6% believe there will be “no change” in business development spending, a decrease from 63% last month

- 3% believe there will be a decrease in spending, unchanged from last month