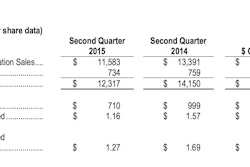

Caterpillar Inc. (NYSE: CAT) today announced profit per share of $0.62 for the third quarter of 2015, a decrease from $1.63 per share in the third quarter of 2014. Excluding restructuring costs, profit per share was $0.75, down from $1.72 per share in the third quarter of 2014. Third-quarter 2015 sales and revenues were $11.0 billion, down from $13.5 billion in the third quarter of 2014.

“The environment remains extremely challenging for most of the key industries we serve, with sales and revenues down 19% from the third quarter last year. Improving how we operate is our focus amidst the continued weakness in mining and oil and gas. We’re tackling costs, and our year-to-date decremental profit pull through has been better than our target. We’re also focusing on our global market position, and it continues to improve even in challenging end markets. Our product quality is in great shape, and our safety record is among the best of any industrial company today,” said Caterpillar Chairman and Chief Executive Officer Doug Oberhelman.

“Our strong balance sheet is important in these difficult times. Our ME&T debt-to-capital ratio is near the middle of our target range at 37.4%; we have about $6 billion of cash, and our captive finance company is healthy and strong. We’ve repurchased close to $2 billion of stock in 2015 and more than $8 billion over the past three years. In addition, the dividend, which is a priority for our use of cash, has increased 83% since 2009,” added Oberhelman.

The additional restructuring actions announced recently are substantial, but necessary to manage through this downturn and keep the company strong for the long term. The actions are expected to lower operating costs by about $1.5 billion annually once fully implemented, with about $750 million of that expected in 2016.

2015 Outlook

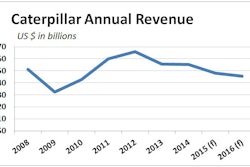

The 2015 outlook for sales and revenues is about $48 billion, and that is unchanged from the outlook that was included with the September 24 announcement of new restructuring actions.

The outlook for profit per share is about $3.70, or $4.60 excluding restructuring costs. The expectation for 2015 restructuring costs has increased significantly, from about $250 million to about $800 million, and is a result of the additional restructuring actions.

The previous outlook for profit per share was provided in late July along with second-quarter 2015 financial results. At that time, the outlook for profit per share was $4.70, or $5.00 excluding restructuring costs and was based on sales and revenues of about $49 billion.

Preliminary 2016 Sales and Revenues Outlook

Sales and revenues for 2016 are expected to be about 5% pecent below 2015. The company expects Construction Industries’ sales to be flat to down 5% with some improvement in developed countries offset by declining sales in developing countries. Energy & Transportation’s sales are expected to be down 5% to 10% as a result of continuing weakness in oil and gas coupled with a weaker order backlog than in 2015. Mining is expected to be down again, resulting in a decline in Resource Industries’ sales of about 10%.

The preliminary outlook reflects weak economic growth in the United States and Europe with U.S. construction activity impacted by low infrastructure investment and continued headwinds from oil and gas. It also reflects a slowing China, Brazil in recession and continuing weakness in commodity prices.

“Managing through cyclicality has been critical to Caterpillar’s success for the past 90 years; it’s nothing new for us or our customers. When world growth improves, the key industries we serve – construction, mining, energy and rail – will be needed to support that growth. We’re confident in the long-term success of the industries we’re in, and together with our customers, we’ll weather today’s challenging market conditions,” Oberhelman said.

“We can’t control the business cycle, but we continue to drive improvements in our business. We’re implementing Lean to drive improvements through our businesses and executing our Across the Table initiative with dealers to improve our market position, service performance and value to customers. We’re also investing in emerging technologies and data analytics tools to continue our role as an innovation leader for our customers. As we look ahead to what will likely be our fourth consecutive down year for sales, which has never happened in our 90-year history, we are restructuring to lower our cost structure. It’s painful and will affect thousands of people, but is essential for the long-term health of the company and should position us for better results when conditions improve,” added Oberhelman.

Click here to download the full version of the Caterpillar Inc. 3Q 2015 results release.