Associated Builders and Contractors (ABC) Chief Economist Anirban Basu, American Institute of Architects (AIA) Chief Economist Kermit Baker and National Association of Home Builders (NAHB) Chief Economist David Crowe predicted continued construction industry growth in 2016 during a joint economic forecast web conference.

“The nonresidential construction sector gained momentum over the last year and should continue to expand into 2016,” said ABC Chief Economist Anirban Basu. “The construction industry has benefited from increased stability stemming from low materials prices and greater certainty regarding federal budgeting and monetary policy, although a lack of appropriately skilled labor will remain a challenge for contractors. ABC predicts the nonresidential construction segment will experience 7% nominal growth in 2016.”

“Led by tremendous demand for energy-efficient spaces, spending on home improvements is on track to reach an all-time high by year’s end,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “The office and retail sectors are expected to lead the commercial real estate market in 2016 with near double-digit increases in construction spending expected.”

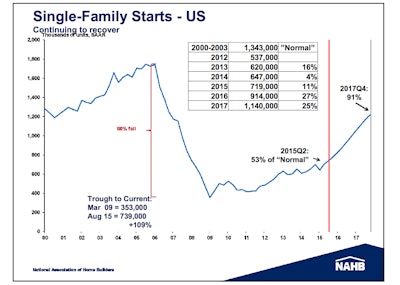

“We expect the residential construction sector to continue its gradual recovery as we head into 2016,” said NAHB Chief Economist David Crowe. “Steady employment and economic growth, along with attractive mortgage rates and home prices will keep the sector on an upward trajectory as we go forward, however persistent headwinds including labor and lot shortages will continue to hinder a more robust recovery.”

Each economist discussed leading, present and future indicators for sector performance, including ABC’s Construction Backlog Indicator (CBI) and Construction Confidence Index (CCI), AIA’s Architecture Billings Index(ABI) and Consensus Construction Forecast and the NAHB/Wells Fargo Housing Market Index (HMI).

View an archived version of the web conference.