It started with the 2011 release of the Associated Equipment Management Professionals (AEMP) telematics standard, and then Caterpillar’s 2016 move to become the first original equipment manufacturer (OEM) in the construction space to open up its equipment management software platform to other equipment brands, contractors have been on a path towards unlocking the true business value of equipment data.

Other OEMs have followed Caterpillar. Case has added mixed fleet capabilities to its SiteWatch telematics platform. Volvo has added AEMP 2.0 compliance with enhanced support for mixed fleets to its CareTrack telematics offering. Most recently, Komatsu announced increased interoperability for My Komatsu, its digital interactive hub for telematics data, parts, manuals and other support tools, which now offers increased capabilities to integrate and display fleet data from other equipment brands.

A Gradual Progression

“Today, a company like Tenna is not seeing prospects who just want a ‘telematics’ box checked off as they look for an asset management software solution,” Tenna Chief Business Development Officer Russ Young said. “Prospects are looking for specific ways they can harness telematics data sometimes even outside of equipment asset management, to drive broader business processes.”

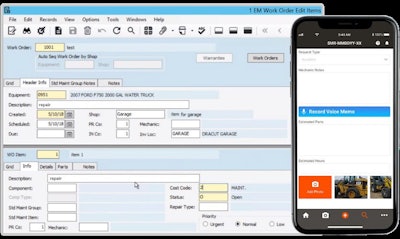

The jumping off point for this broader and process-driven consumption of telematics data is equipment management, as third party telematics software products like HCSS Equipment360 leverage telematics data to structure a preventive maintenance program, drive time cards for maintenance technicians, inspection reports and work order functionality.

HCSS Heavybid also integrates with accounting software for maintenance technician payroll. Integrations between telematics data, equipment management software and accounting are getting deeper though, as evidenced by an expanded integration between Tenna and Trimble Construction One/Viewpoint Vista product.

“This integration, like Tenna and Trimble-Viewpoint’s greater partnership, solves a multi-million-dollar business need for contractors, making it easier for them to see where they are bleeding capital and helps them get better control over how they leverage their current resources to ultimately benefit the books,” Young said. “Knowing more by seeing data clearly within the integrated systems and being able to better account for equipment costs and investments allows contractors to take strategic actions to own less, rent less, better maintain and optimize what they have, and deliver work more with less downtime, which leads to increased project margins and higher revenue.”

Products including including Tenna, Trimble Pulse and Trackunit have harnessed telematics data to optimize equipment utilization, based either on operating data collected from an OEM telematics unit or aftermarket sensors that sense vibration. By assigning equipment to specific projects and then capturing operating information, often from aftermarket equipment guidance or automation systems that intimately understand the mechanical steps in each equipment duty cycle and GNSS-based location data, contractors can automate reporting on production as part of an application for payment process.

Tenna has deepened its integration with Trimble Viewpoint Vista.Tenna

Tenna has deepened its integration with Trimble Viewpoint Vista.Tenna

Construction Operations Built Around Telematics

While equipment management decisions and processes are increasingly being trigged and informed by telematics data, with its T3 operating system for construction, EquipmentShare goes several steps further by harnesses telematics and equipment data not just from a maintenance but from a resource management standpoint, broadly across its extended fleet and within individual construction contractor environments.

T3 is the foundation of its nationwide equipment distribution network and hooks into telematics utilization data from every machine in the network. EquipmentShare in 2021 began extending and marketing T3 as an operating system for contractors, expanding their remit beyond management of rental and owned equipment to broader management of assets, people and materials in a construction setting. The application ingests equipment telematics data, data from its own timecard application, mobile expense capture and inventory modules.

- Apps in the T3 suite include:

- Fleet—OEM-agnostic telematics

- Time Tracking—Schedule management, labor time card capturing, work order management and more

- E-Logs—Electronic Logging Device compliance with digital reporting

- Analytics—Customizable reports on utilization, job cost and more

- Work Orders—For equipment maintenance

- CRM—Track vendors and customers

- Cost Capture—Record expenses from a mobile device along with invoices for full expense management

- Inventory—Plan inventory consumption across jobs with a streamlined intake and parts order workflow

- Rent Ops—Manage assets on projects with external and internal rental functionality

According to EquipmentShare Director of Product Angela Page, because T3 underpins the EquipmentShare rental experience, customers can easily add functionality from the application suite to extend the solution they are already relying on deeper into their contracting business as a broad resource management solution. But there is also a dedicated team of sales reps specifically for T3—a couple dozen strong at the time of our June 2022 debriefing. Existing customers are assigned their own customer success manager based on their region, which would help EquipmentShare develop deep rapport with that customer base

EquipmentShare Big Picture

In our debriefing, EquipmentShare CEO William Schlacks, the company sees a future well beyond its current footprint. Like other companies leveraging real-time telematics information from equipment like Trackunit, EquipmentShare wants to deliver a transformational approach to, industry-wide issues rather than just facilitating existing business processes.

“Our initiatives align with what the major macro vision is—the big problems faced by contractors,” Schlacks said. “There has been no platform that creates visibility into the job site, and by extension of that, people, equipment and materials. Our next steps will involve our getting more heavily involved in inventory. Inventory visibility probably does not exist in any industry yet, but is completely disconnected from operations in the construction industry. Visibility is all about enabling status information through workflows, and one of the primary workflows is actually rental … But our next steps in this product will take us much deeper into inventory management and our warehouse management system (WMS).”

Beyond the Mixed Fleet

As more applications come to market that build broad business processes around standardized and brand-agnostic telematics data, some other telematics and fleet management software vendors are taking the opposite tack.

Fleet management software vendor Motive announced a partnership in June of this year with Navistar that will connect Motive's Automated Operations Platform with Navistar’s OnCommand Connection telematics and Advanced Remote Diagnostics solutions.

“Navistar has expertise in areas around their equipment we cannot have,” Motive Chief Product Officer Jairam Ranganathan said. “We can get fail codes easily through telematics, but being able to interpret those fail codes, that is the best role for the OEM. They provide software solutions for those kinds of problems. It is important to partner—stuff around tracking and things of this nature, we are very good at that. That is not the focus for a company like Navistar.”

The type of equipment and use case may help determine how important deeper hooks into the OEM will be.

“Their equipment being run at high utilization rate,” Ranganathan said. “They do a good job at technology to ensure the customer has a good experience. AEMP is a good standard, but it only covers a certain level of depth. The Navistar partnership lets us go a lot more deeply into areas not covered. What we want to do is capture more than the code—we also want the logic to prioritize and handle that code. If this code is showing, what does that mean for your equipment versus if a different code string is shown. We have many sensors capturing things about operation of equipment. Specific maintenance insights require deeper data sets on the equipment. So we believe the long term strategy should be partnerships. We believe we can do the telematics, the tracking, the safety—but to get to the deep nuance around maintenance, Motive should partner with OEMs.”

Motive and Navistar are not alone in pursuing a partner-centric approach to telematics data. John Deere, have partnered with HCSS, and Mitsubishi Logisnext Americas has partnered with PowerFleet for telematics.

A Central Role

Telematics data, thanks to standardization, can now be broadly captured, broadly enough to become a central component of equipment-oriented business processes. But equipment is only one inflection point inside a contracting business, and telematics data is now being mashed up with data on people, cost, projects and more.