FMI, a provider of management consulting and investment banking to the engineering and construction industry, announces the release of its Third Quarter Nonresidential Construction Index Report. Plunging 5 points to 54.8, the index is back to Q2-2010 levels.

Notably, confidence in the economy by panelists took a huge hit, dropping 24.7 points. “Beware of the upturn,” is the sentiment expressed by a number of panelists. They raise concerns that too many contractors have been taking on too much low-bid work just to keep their backlogs full. The result is businesses are becoming unable to finance ongoing losses.

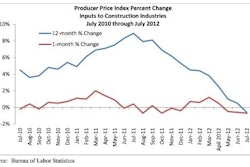

On the rise is the number of contractors participating in self-funded projects as a financing partner with owner/developers. One panelist stated, “Eighty-five percent of our work is being funded through self-funding or in some case, equity investors.” This is due in part to fewer bank loans for construction. Add to this rising material and labor costs, as well as lower project management fees and profit margins, and the result is an upturn in bankruptcies for industry firms. Nearly a third of NRCI panelists have seen a decline in trade contractors, with more than 10 percent noting fewer general contractors and design firms.

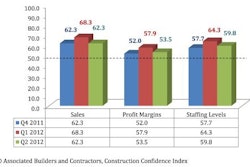

If there is a bright side, temporary gains in the economy have been enough to boost sales and release some projects that have been on hold for a long time. The result is that panelists report that their backlogs have improved somewhat. This is the first time backlogs have shown improvement since the second quarter of 2011.

Download a copy of the full Q3 report.