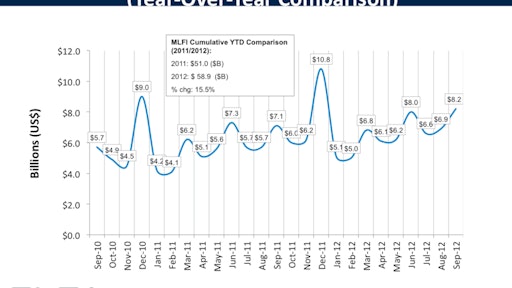

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for September was $8.2 billion, up 16 percent from volume of $7.1 billion in the same period in 2011. Volume was up 19 percent from the previous month. Year-to-date cumulative new business volume increased 16 percent.

- Receivables over 30 days decreased for the fourth consecutive month to 1.8%, down from 1.9% in August and down 22% when compared to the same period in 2011.

- Charge-offs were up slightly from the previous month at 0.5% and down by 44% compared to the same period last year.

- Credit approvals increased to 79.6% in September from 77% in August.

- 54% of participating organizations reported submitting more transactions for approval during September, down from 65% the previous month.

- Total headcount for equipment finance companies was down 0.5% from the previous month and declined 3.2% year over year.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for October is 53.3, relatively unchanged from the September index of 53.0, reflecting steady industry confidence despite economic, political and regulatory concerns.

"While September’s sharp increase in new business volume is indeed encouraging, some equipment finance markets continue to show some softness," said ELFA President and CEO William G. Sutton, CAE. "Also, the run-up to the U.S. elections, high energy prices and continuing uncertainty brought about by fragile European economies is muting what might be an otherwise robust recovery for the U.S. economy."

"Double digit improvement in several index categories is certainly a good sign for our industry," said William Stephenson, Chairman, Global Vendor Finance, De Lage Landen International B.V. "The improvement trend in these fundamental industry metrics reflects a relatively stable but cautionary outlook for the future."