Current construction costs rose for the 30th consecutive month in July according to IHS and the Procurement Executives Group (PEG). The headline current IHS PEG Engineering and Construction Cost Index (ECCI) registered 55.9 percent in July, softer than the June reading, but still comfortably in positive territory. This month, gains from steel-related products kept the index in positive territory; however this should be viewed as a temporary cost pressure. Cost pressure in other material and equipment categories remain fairly modest and, in our view, price increases for fabricated structural steel will either be light or non-existent for the rest of 2014 in the United States.

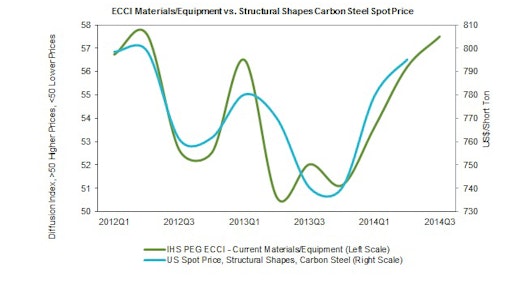

Since early 2012, fabricated structural steel has lagged the performance in the broader carbon steel market (as shown in the attached chart), whereas the last gasp of price increases from steel mills came in April of this year, according to Paul Robinson, senior economist of the Pricing and Purchasing Service at IHS. Fabricators, he said, are only now passing on the cost rise.

“The price increases for fabricated structural steel came on artificial tightness in the North American market after a colder and longer-than-expected winter, as well as unplanned maintenance at two facilities in the Midwest,” Robinson said. “With those shocks out of the way, there is little upside for prices on the horizon.”

Materials and equipment prices remain stuck in neutral

The materials/equipment component of the ECCI stayed firm at 57.3 percent, level with the June reading. For a third month, all 12 subcomponents stayed at or above the neutral mark. In addition to fabricated structural steel, alloy steel pipe, pumps and compressors as well as heat exchangers all recorded stronger movements.

Alloy steel pipe again posted the highest reading of any subcomponent in July – a position it has retained for five of the past six months due to still-elevated nickel prices. Despite reflecting stable or rising prices, there was a notable easing in copper-related products in June; wire and cable, transformers, and electrical equipment all recorded lower readings.

Labor index levels off; tightness still a concern in skilled labor market

The current subcontractor labor market index eased to 52.3 percent in July, down 4.7 percent from last month. Regionally, the strongest markets for workers remain in the U.S. South and Midwest, but all remaining regions reported flat readings relative to June. Respondents again expressed concern over tightness in labor markets in these two regions, specifically referencing qualified welders.

Six-month index nears all-time record; big expectations for subcontractors

The six-month headline expectations index strengthened to 76.4 percent in July, the second highest reading on record, with both the materials/equipment and subcontractor labor subcomponents showing upward movements. The materials/equipment portion strengthened to 77.1 percent, the highest reading since April 2012, with pockets of strength focused in alloy pipe and copper-based wire and cable. Expectations for subcontracted labor registered 74.8 percent, up 5.7 percent from June, driven by stronger expectations for Western Canada and the U.S. Midwest and South.

Both the materials/equipment and subcontractor indexes have been rising steadily since January on expectations that hydrocarbon project work will accelerate over the second half of 2014 and into next year.