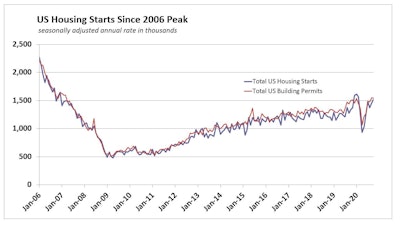

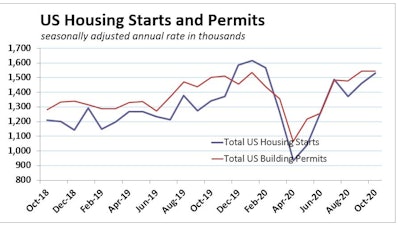

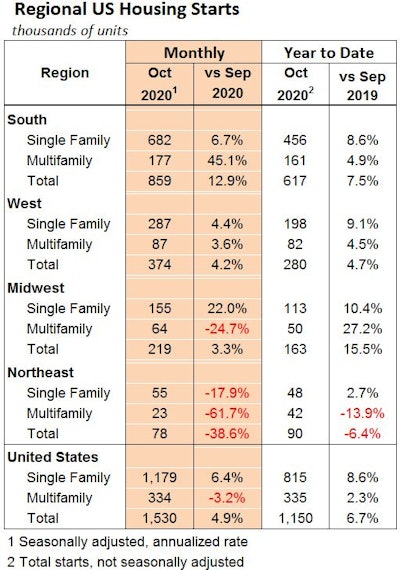

Total U.S. housing starts climbed 4.9% in October, following an upwardly revised 6.3% increase in September. Single-family starts accounted for all of October’s increase, as multifamily starts fell 3.2%.

Permits issued for all types of new homes occurred at a seasonally-adjusted annual rate of 1.545 million in October, unchanged from September.

Builder confidence surges with single-family

Phoenix, Salt Lake City, Dallas, Austin, Charlotte, Tampa, Nashville and Jacksonville have been among the fastest growing markets on the receiving end. Just over 80% of all single-family homes built over the past year have been in South or West, which means that construction can continue at a much higher pace during the winter months than in prior years.

But don’t miss a 22% October increase in single-family starts in the Midwest.

Has multifamily leveled off?

The move to suburban markets is not limited to single-family homes.

“Data on asking rents suggests there has been a clear shift in renter preferences away from urban/lifestyle apartments for suburban apartments that offer more outdoor amenities,” says Mark Vitner, senior economist with the Wells Fargo Economics Group. “The bulk of apartment construction this past decade has been urban/lifestyle apartments and rents are falling in most major markets that had seen a boom in high-rise development this past decade.”

Development is now pivoting toward the suburbs, but overall starts have still pulled back in a major way since the start of the year.

Multifamily starts, the bulk of which are apartments, have been unchanged since August at 351,000 units. Multifamily starts may level off near their current level. There is still an immense undersupply of all types of housing, particularly affordable rental housing.

“Weakness for multifamily development is consistent with our forecast, as multifamily permits for 5+ unit production are now down more than 11% on a year-to-date basis,” says Robert Dietz, chief economist with the National Association of Home Builders. “The year 2021 will see a decline for multifamily starts, although there will be strength for low-rise multifamily development.”