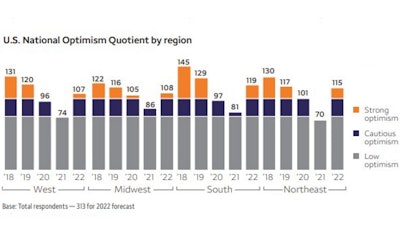

Economic indicators like Wells Fargo’s Optimism Quotient, based on surveys of contractor sentiment about the future, can be subjective. But this survey, which underpins the Wells Fargo 2022 Construction Industry Forecast, has a history of predicting change in construction industry activity that makes its 44% improvement worth breaking down to study.

The Wells Fargo 2022 Construction Industry Forecast released today shows surging optimism among nonresidential contractors and industry equipment distributors for increasing profits and new equipment sales in the year ahead. The benchmark U.S. National Optimism Quotient (OQ) registered 112. Wells Fargo calls any reading above 100 “strongly optimistic,” so it’s curious that Jim Heron, national sales manager for Wells Fargo Equipment Finance’s Construction Group, chooses to call it a sign that industry leaders “ended 2021 feeling cautiously optimistic. Wells Fargo's Optimism Quotient for construction tends to be accurate, reflecting, for example, recovery of industrial production in the 2009-2015 climb out of the Great Recession.Wells Fargo Securities LLC

Wells Fargo's Optimism Quotient for construction tends to be accurate, reflecting, for example, recovery of industrial production in the 2009-2015 climb out of the Great Recession.Wells Fargo Securities LLC

“Some of the executives that we've surveyed have concerns about the earlier part of the year, but they feel that their concerns early in the year will diminish. And by the end of the year, they're expecting increasing profits as well as an increase in revenues.

“The score is absolutely optimistic,” Heron continues. “Calling it ‘cautious optimism’ is a bit of my adjusting, based on the comments from the executives, as well as some of what Construction optimism lagged recovery of spending on public nonresidential construction after the Great recession, but preceded growth in private construction spending.US Census Bureau, Construction Put-In-Place

Construction optimism lagged recovery of spending on public nonresidential construction after the Great recession, but preceded growth in private construction spending.US Census Bureau, Construction Put-In-Place

The OQ’s 44% increase is from the 2020 mark of 78 a year earlier. The last time Wells Fargo measured OQ growth of this scale was in 2010 and 11. One big difference: in recovering from the Great Recession, the OQ started at 42 in 2009.

“I'm still very, very optimistic. I think 2022 is going to be a very good year for the construction industry and I think 2023 is even going to be better,” says Heron. “So I don't want our ‘cautiously optimistic’ to diminish the significant increase in the optimism quotient. The number itself is purely strong optimism.”

“Finding skilled workers and supply chain disruptions are executives’ two biggest concerns,” said James Heron, national sales manager for the Wells Fargo Equipment Finance Construction Group, which sponsored the report for its 46th year. “However, in this rapidly changing environment, they also believe that the passing of the new infrastructure bill and historically low interest rates will create new opportunities in the future.”

Why expect materials and labor shortages to ease?

The Infrastructure Investment and Jobs Act, commonly referred to as the Bipartisan Infrastructure Bill, is good news for the economy, and especially the construction industry, but it’s probably longer-term news than 2022.

“The reason for the increasing optimism, in my opinion, in the latter part of 2022 is in part due to the infrastructure bill,” says Heron, “But more so due to the belief that supply chain disruptions are going to slow down, as will COVID’s interference on our operating environment.”

Wells Fargo Securities Managing Director and Senior Economist Mark Vitner explains that some of this change is built into the season, and some will arise from growing experience with the coronavirus.

“As the holiday season winds down and the calendar moves into 2022, logistics networks presumably will be under far less stress from the onslaught of imports arising from the upshift in holiday spending. Less congested transportation channels should foster the movement of building materials and other freight around the country. Furthermore, the growing armament of COVID-19 treatments and vaccines should help reduce unplanned factory closures and port disruptions, which will allow production to catch up with demand.”

Building-material pricing and availability is already becoming more contractor friendly.

“Supply constraints appear to be easing slightly as the winter brings a seasonally slow period for construction projects in the Northeast and Midwest,” says Vitner, “Which could potentially free up resources for the South and West.”

Vitner observes that some systemic changes in construction and in the labor force are creating conditions that should begin to ease construction’s labor shortage.

“While unlikely to meaningfully abate, worker shortages should improve in 2022. The absence of fiscal support and rising wages across the construction industry will help convince sidelined workers to return. Less restrictive immigration controls should also help augment the supply of labor.”

“Even before the pandemic ignited a surge in early retirements, the pace of retirements was far exceeding the number of new entrants into the construction industry. Given that construction work has mostly fallen out of favor with younger generations thanks to the rise in less physically intensive service-based occupations, the construction industry as a whole will likely continue to endure the challenge of labor shortages over the long term.”

Which nonresidential segments will lead?

While remote and hybrid work models will weigh heavily on new office construction, Vitner expects new office construction to begin slowly advancing in 2022. And housing constructions’ steady march back to the suburbs is likely to lift retail construction.

“A massive overhang of sublet space in the large gateway markets such as New York City and San Francisco means most new office construction will be concentrated in Denver, Austin, Charlotte, Miami and other Southeastern and Mountain West markets with robust population and employment growth. Spending on retail projects is also poised to strengthen, as retailers follow residential development spurred by the population shift to the suburbs and secondary metro areas throughout the Sun Belt.”

Rising e-commerce and snarled supply chains continue to drive demand for warehouses, distribution centers and logistics facilities.

“Manufacturing is likely to be another bright spot,” says Vitner. “In addition to global manufacturing capacity being partially re-shored as firms seek more resilient supply chains, higher commodity prices will likely allow some LNG and petrochemical manufacturing projects to get back underway, notably in the Western Gulf states.”

Wells Fargo queried hundreds of industry executives nationwide in September 2021 to determine this year’s National Optimism Quotient, an outlook measure for nonresidential construction business for the year ahead. The survey posed questions about equipment sales, purchase expectations, and rental market trends, while also exploring major cost and risk concerns that industry executives were considering as they geared up for the new year.

How much improvement do the economists expect?

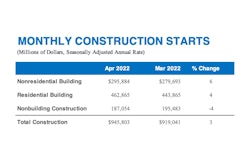

According to Dodge Data & Analytics, total non-residential building starts have begun to climb higher, with starts up 11% for the first 11 months of 2021.

“What’s more, the forward-looking Architecture Billings Index has been solidly in expansion territory for most of the past year,” says Vitner. “Taking these factors into consideration, we anticipate private non-residential spending to bounce back from an estimated 5.8% decline this year and increase 2.8% in 2022, as commercial, institutional and manufacturing expenditures all begin to pick up modestly.

“We also look for a 3.2% rise in public non-residential construction spending in 2022 and a 7.4% increase in 2023. State and local governments are now flush with cash from unexpectedly strong tax receipts and federal aid, and new funding now appears to be flowing to public works projects. The bulk of COVID relief funds to state and local governments already have been disbursed, but another $100 billion of grants are yet to be released.”

The Infrastructure Investment & Jobs Act provides $550 billion of new spending for roads, bridges, mass transit, water and numerous other infrastructure projects. It will significantly boost public sector construction, but the bulk of that spending is not expected to materialize for a year or more.

What construction execs forecast

At 112, the 2022 Optimism Quotient score represents a significant increase compared to the 2021 OQ of 78, and handily beats the 2020 OQ of 99, gathered as the industry neared its pre-pandemic peak late in 2019. Contractors and distributors alike are optimistic in their 2022 outlook for local, nonresidential construction; roughly half expect it to increase compared to 2021.

Executives say the greatest risks to the construction industry are the availability of skilled workers and supply chain disruptions, followed by rising material costs and inflation.

Key opportunities lie in an improved overall economy, improved qualified labor availability, the recent Congressional passage of the Infrastructure Bill, and low interest rates.

Equipment distributors are largely optimistic about sales of new equipment with 61% stating they expect an increase in sales. Contractors have mixed expectations:

- 43% feel equipment buying will remain the same

- 38% feel it will increase

- 14% feel it will decrease

To learn more, download Wells Fargo’s complete Construction Forecast Survey.