Healthcare coverage is a complicated, confusing topic that seems to change daily. With continuous media coverage regarding ACAs, HRAs, ARAs and HSAs, it’s almost impossible to interpret the insurance proposals from insurance companies, brokers, consultants and even associations that have insurance plans in place for members. This leaves company CEOs and CFOs challenged to provide proper healthcare benefits to employees for a reasonable amount of money, and ensure employees believe the benefits they’re receiving are reasonable, as well.

Large contractors most likely have internal or external help to decipher the different programs and determine what best fits their operation. Those using union employees have the issue settled for them (as long as the plans are properly funded). But contractors with 50 employees or less will probably not hire a consultant to help manage the insurance maze.

This being the world we live in, there is not much you can do but investigate different programs available. Do some homework via discussions with insurance companies, associations, peers and other service providers to find out what plans are offered and what is working for your type of business.

I don’t believe that management can under perform when it comes to employee benefits if they hope to attract and retain quality employees, which we all know is a real plus when it comes to doing profitable, quality work. If you recall, a couple of months ago, we discussed the labor market and what employers are doing to attract those qualified workers. As noted, quality healthcare programs are at the top of the list. With additional construction work on the horizon, CEOs are going to have to bite the bullet if they hope to have the proper staffing they need.

So, we know this health insurance issue is a mess, costly, confusing and very complicated. Consequently, CEOs are forced to:

- find out what other players in their market are doing;

- shop the program with various providers;

- examine various programs available to employees;

- and even get employees involved in the process of picking a program that works best for them as long as they understand how they will participate in the cost.

My guess is the better the program, the more employees will be willing to contribute to the cost. The CEO’s investigations should give him/her an idea of what other players in their market are collecting from their employees.

Look Beyond Traditional Healthcare Choices

The key to the healthcare dilemma is to separate the everyday health issues from the catastrophic costly events. And if you can separate the insurance company activities along the same lines to reduce the “cost” of insurance company overhead, that is even better. In short, health insurance coverage today is out of hand, covering everything with no incentive for the user to shop the price because there is a lack of transparency regarding pricing and costs. It’s a win-win model for insurance companies and the healthcare industry and a lose-lose for employers and employees.

The bright side is you do have options, some of which are very attractive from both a coverage and cost perspective. Out of those available, what are some that are working as of today? Two of them include Health Reimbursement Accounts (HRA) and Concierge Medicine (CM).

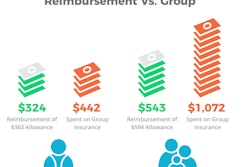

HRAs involve the employer reimbursing employees for healthcare costs. Industry surveys indicate that the monthly reimbursements for an employee with single coverage is in the $400 to $500 range and family coverage is in the $1,000 range. These amounts are set aside monthly for employees to use to pay medical-related bills or health insurance. Compared to group health plans, HRAs save on average 23% for single employees and 49% for employees with families. When you think about this, the HRA is giving employees more control over what they spend and how they spend it. To make it even better, there are tax benefits available for employees.

Are Health Reimbursement Plans a Better Option for Small Construction Companies?

The CM is a new concept that supplies a defined package of care for a fixed monthly fee. This package covers routine care — checkups, stitches, prescriptions, nutrition, etc. — as opposed to specialized care such as heart surgery and other major health issue services.

Dr. Josh Umbehr has been making the media rounds explaining how the CM model works and how it can be cost effective compared to typical group plans. Basically, you pay the doctor a direct fee per month, and thus eliminate the insurance company from the process, which lowers the cost tremendously. The doctor can supply prescription drugs (in most states) and do normal tests in their office at again a tremendous discount because the direct costs are much lower compared to insurance company rates.

Dr. Umbehr’s monthly fees range from $20 to $100, depending on age. You have one fee, no co-pays and no red tape from the insurance company, with discounts up to 80% from standard insurance costs. And you get to name and keep your current doctor!

There are CM models forming across the country. To learn more about how they work, visit Dr. Umbehr’s site at Atlas.md/wichita or search online to read some of his interviews about this model.

To review, HRAs and CMs make programs more user friendly, much cheaper and transparent with less red tape. Most normal healthcare needs are covered at modest cost, with a catastrophic policy to cover the balance. What is not to like?

If you can find an HRA, CM or comparable service to provide healthcare coverage to your employees, you will have a list of qualified workers waiting in line to work for your company. Not only do they get great healthcare, their take home pay goes up in the process.