This article was originally published by the Snow and Ice Management Association (SIMA)

Before you completely shift gears at the end of your snow season, it’s important to look back on a few financial details while any pain or success is fresh in your mind. We spoke with Brian Jacobson, CPA/MBA, of ClearView Financial Services in Pembroke, MA, who offers the following suggestions:

Evaluate job profitability

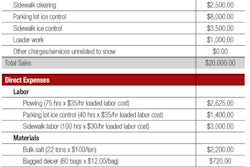

Look at your budgeted costs for each customer and compare to your actual expenditures. Did you price your work appropriately for the level of service and customer expectations? If you aren’t already tracking your job costs, it’s time to start.

“Once you head into spring and summer, you may forget how much of a pain a customer was and how much money you didn’t make on that contract if you had multiple callbacks, etc.,” he says. “Everyone likes the big customers and marquee names but you need to make sure you’re not losing money on them. Tracking job costs will help you determine whether your clients are ‘keepers.’ ”

Evaluate your portfolio mix

You’ve heard it many times, but creating a snow portfolio that incorporates a mix of contract types can help with cash flow and mitigate risk. Condo associations/HOAs, for example, may prefer a steady year-round fee because it’s unlikely they can request additional funds from residents if snow costs fluctuate. “It’s a budgeting mechanism for them. They like the known bill, and may pay more to get it.” Fixed-fee customers can help fund gaps in your cash flow, whereas those who pay per-push, etc., will help with cash flow during the season.

Start locking up next season

If you did a great job for your clients, get them to renew contracts for next season while your success (and theirs) is fresh in their minds. Most won’t want to talk snow in August and my push you closer toward fall. Commitments now will allow you to properly budget for salt and equipment purchases and labor needs.

Establish a line of credit

The snow might have melted but there’s a good chance snow receivables are still outstanding. A line of credit to help fund the overlap may be an option, Jacobson says. It’s also worth considering (but cautiously) paying some of your final snow bills by credit card. “If they’ve strung out their vendors and need to make good, they may put them on a credit card, which gives them another 30 days to get cash flow settled while waiting for snow money. They can use some of their early landscaping money to pay off snow bills.”

Collecting on receivables

If you have customers who are dragging their feet on payments, you may have some untapped leverage. While it might be too late for this spring, Jacobson suggests using spring cleanup to get them to pay promptly. “Don’t tell them you’re not coming until you get paid. Let them know that spring cleanups are scheduled in order of when they’re paid in full. Commercial clients, especially, don’t want to get jumped because they want their properties to look great.” Leveraging damage repairs is a little more complicated, especially if your team was responsible. Your other obvious method for collecting could be to withhold service in the upcoming season until past-due invoices are paid.

Start shopping for equipment

Just as you should be lining up your commitments for the coming season, vendors would like to firm up equipment purchases. Buying in July and August will likely reap better prices and favorable financing terms. Committing early may also allow you to negotiate better terms. “If you commit, for example, to buying X amount of plows now, you may be able to put down a small deposit and request no payments until 2015, which will allow you to collect on your first snow payments before having to pay the first installments.”

Cheryl Higley is editorial director of Snow Business magazine.

Interested in subscribing to SIMA's magazine?

![[VIDEO] Following Federal Regulations for Snow Equipment](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2016/09/default.57ebe41aca913.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)