On March 18, 2022, the Department of Labor (DOL) announced a Notice of Proposed Rulemaking, which set in motion a year-and-a-half long process to modernize the Davis-Bacon and Related Acts (DBRA). Comments came in from all corners of the construction industry, including labor groups, workers, and all manner of industry stakeholders.

The updates announced on Aug. 8, 2023, go into effect 60 days from that date and are the most comprehensive in nearly four decades. The final ruling issues major changes in regards to the administration and enforcement of labor standards applicable to all Federal and federally subsidized construction projects. This obviously includes federally funded highway projects which fall under the jurisdiction of the DBRA.

“Modernizing the Davis-Bacon and Related Acts is key to making sure that the jobs being created under the Biden-Harris administration’s Investing in America agenda are good jobs, and that workers get the fair wages and benefits they deserve on federally funded constructions projects across the nation,” said Acting Secretary of Labor Julie Su. “This updated rule will create pathways to the middle class for more families and help level the playing field for high-road employers because companies who exploit their workers, or who don’t pay workers fairly, should never have a competitive advantage.”

The new DBRA rules significantly alters how the "prevailing wage rate" is determined, defined, complied with, and enforced. As it concerns the asphalt and road building industry, and what roles will now fall under the umbrella of the prevailing wage rate, there are three areas of focus which impact it the most. The newly expanded, codified, and clarified rules for "site of work" flaggers, material suppliers, and truck drivers.

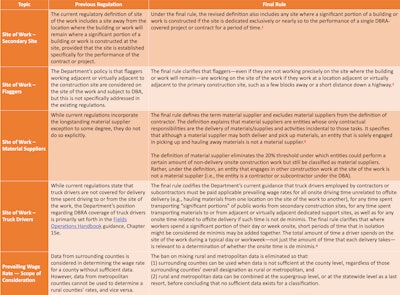

Here is a summary table, created by Jay Hansen, Vice President of Government Affairs,

Table prepared by Jay Hansen, Vice President – Government Affairs, Surface Tech, LLC, using data and information from the Department of Labor’s website.

Table prepared by Jay Hansen, Vice President – Government Affairs, Surface Tech, LLC, using data and information from the Department of Labor’s website.

In the past, there was some gray areas about material suppliers. Do they pay the prevailing wage rates to the truck drivers carrying the material in? If the truck driver was going in, and he was just dropping off material, and maybe he was doing something else on the job site that was de minimis, then prevailing wage rates did not take effect. Sometimes drivers might find themselves, for one reason or another, on site for extended periods of time waiting to make their deliveries.

The new regulations establish clear lines of when you have to pay truck drivers the prevailing wage rate. For instance, if a truck driver hauling material is just dropping off and picking up, you don't have to pay prevailing wage rates. However, if they're doing literally anything else it falls under the DBRA.

The DOL generally did not count short periods of a few minutes onsite just to drop off materials as de minimis. However, the total amount of time a driver spends on the site of work during a day or workweek—not just the amount of time that each delivery takes—is considered in determining whether the driver’s onsite time was de minimis.

Likewise, flaggers might be a mile down the road from the main work site, which previously meant you didn't have to pay prevailing wage rates. The new ruling defines such a space as "virtually adjacent," because they're tied to the project directly.

What is the Prevailing Wage Rate and How Is It Calculated?

If a majority (over 50%) of wage rates in a classification are the same, that is the prevailing wage, but if there is no majority, then the wage rate earned by the greatest number of workers, provided that at least 30% earn that rate, is the prevailing wage. The DBRA requirements apply to an estimated tens of billions of dollars in federal and federally assisted construction spending each year and provide minimum wage rates for hundreds of thousands of U.S. construction workers.

A Win For Labor...and Also For Employers?

From the perspective of laborers and labor groups (both union and non-union), these regulatory adjustments result in real quality of life improvements for workers. However, with wages likely to increase, a larger pool of job seekers may potentially come to fill the many open positions our industry currently has available.

As an example, in a recent article by Forbes, there was a 50% surge in those looking into UPS employment after the recent landmark deal was made between the Teamsters and the company. The deal, worth an estimated $300 billion over the lifetime of the contract, avoided what would've been the single largest labor action in the United States in 60 years.

The final rule’s regulatory changes improve the department’s ability to administer and enforce DBRA labor standards more effectively and efficiently. These changes include the following:

- Creating new efficiencies in the prevailing wage update system and making sure prevailing wage rates keep up with actual wages which, over time, would mean higher wages for workers.

- Periodically updating prevailing wage rates to address out-of-date wage determinations.

- Providing broader authority to adopt state or local wage determinations when certain criteria are met

- Issuing supplemental rates for key job classifications when no survey data exists.

- Updating the regulatory language to better reflect modern construction practices.

- Strengthening worker protections and enforcement, including debarment and anti-retaliation provisions.

For more information and answers to FAQ on the Davis-Bacon Rulemaking, visit https://www.dol.gov/agencies/whd/government-contracts/construction/rulemaking-davis-bacon/faqs

The full text of the updated regulations, all 802 pages worth, can be found here: https://www.dol.gov/sites/dolgov/files/WHD/davis-bacon/Final-Rule_Updating-the-Davis-Bacon-Related-Acts.pdf