Construction News Tracker is presented by Caterpillar and produced by ForConstructionPros.com.

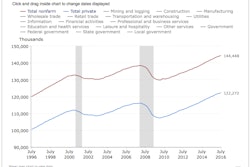

The nation's jobs picture continues to brighten as the latest economic statistics show strengthening. For construction, the sector gained 14,000 jobs from June, pushing industry employment up 3.3% over 2015. Bureau of Labor Data reports nonresidential specialty trade contractors saw the best growth adding 8,900 jobs while residential specialty trade contractors enjoy the best year-over-year surge at 5.1%. AGC reports average weekly hours are up to 39.2 indicating contractors are pushing existing employees to work more hours to make up for the labor shortage.

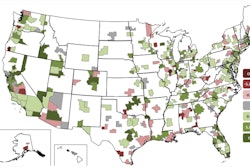

Meanwhile, construction employment rose in 228 of 358 metro areas nationwide for June year to year. AGC is pressing Congress to act on reforming federal funding to pay for additional career and technical education classes to encourage high school students to consider construction careers. Nationwide, the southern California region around Anaheim added the most jobs in 2016 followed by Denver, Phoenix and Orlando.

Is the second quarter's sliding U.S. construction spending a harbinger of things to come? Could be.

US Construction Spending Begs Watching after Last Quarter's Slump

Economists consensus forecast anticipated an increase of five-tenths of a percentage for the value of construction put in place in June but missed the mark. The Commerce Department estimate showed the value slipping six-tenths of a percent. Economists missed big in April and May as well, forecasting less than 1% increases in U.S. construction spending. But seeing Commerce Department estimates fall 2.9% in April, and drop one-tenth of a percent in May, spending in the second quarter is 2.7% greater than the same period in 2015. These misdirected forecasts have us closely monitoring the months ahead to see if the second quarter construction spending weakness is just coincidental volatility or if our construction has reached a turning point that has eluded economists outlooks up to now.

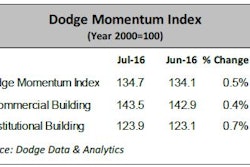

The Dodge Momentum Index shows a slight increase of five-tenths of a percent in July from a revised June score of 134. Nonresidential sectors also pushed ahead with institutional up 0.7% and commercial up 0.4% and is the fourth consecutive index rise. As of now, there are 11 $100 million+ projects in planning stages nationwide — a solid barometer for construction.

Another round of U.S. DOT TIGER grants has been awarded totaling $500 million — the eighth round of economic recovery money. Forty diverse areas of the nation were awarded funds ranging from Pittsburgh to Brownsville, TX, Little Rock and Scott County, MN.

I had the occasion recently to run into AGC Chief Economist Ken Simonson at the Sage Summit 16 conference in Chicago and asked him for the latest forecast in construction for the rest of this year and 2017.

The American Institute of Architects' (AIA) latest building forecast predicts that nonresidential spending will rise about 6% in the last half of 2016 and 5.6% in 2017 — a slight downturn from its February projection. AIA says it appears construction growth will be more tempered over the next 18 months with the biggest slowdown in the industrial construction field. AIA did point out it believes jobs, consumer confidence and low interest rates remain positive for the near future.

Caterpillar continues to struggle with the downturn in its mining sector as the company recently reported sales dropped 17% from the second quarter of 2015. Cat's machinery and engines suffered a hit of 44% in operating profit. Despite this, Cat's second quarter sales and profit overall exceeded forecasts though the company indicates more loss is possible through this year.

How embarrassing can it get? How about $500 million worth. that's what it will cost to raise a five-year-old bridge at Newport, DE, a half foot.

The Delaware DOT is paying a contractors to raise the entire bridge over CSX rail tracks after it was discovered the original contractors erred in its design. CSX refused to sign off as it expects to be able to double stack rail container trains, which would be unable to fit beneath the bridge unless its height is increased. COT engineers believe the original survey crews measured from the wrong points when the span was configured five years ago. And no one is admitting to the mishap, even though the price tag is a half billion dollars.

In closing, to be free it is not enough to beat the system — one must beat the system every day.

This is Construction News Tracker looking over the industry that makes the world a better place. Presented by Caterpillar and produced by ForConstructionPros.com.

Follow us on social media at Twitter using #constructionnews and both YouTube and Facebook as the streaming Web never ends.