Beginning early next year, the state of Washington will start a pilot project in which 2,000 volunteers pay a mock tax on the number of miles they drive on Washington state roads, rather than on the amount of gas they use.

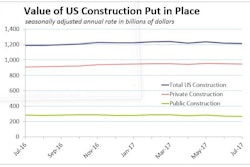

Next year the Washington State Department of Transportation expects gas-tax revenues to rise by 0.9 percent. It expects its construction costs to increase by 2.6 percent. And the disparity is expected to repeat.

As cars become more efficient, their drivers pay less in taxes. And the state has less money to fix roads. The average car in Washington today gets 20.5 miles per gallon, according to research by the Washington State Transportation Commission.

“By the time we hit about 35 miles per gallon, which our forecasters say will be in about 2035, we lose about 45 percent of gas-tax revenue,” said Reema Griffith, director of the Transportation Commission.

Participants in the pilot study won’t actually be paying yet, but the planned rate is 2.4 cents per mile, which equates to the current gas-tax rate for a car with average gas mileage.

They’ll choose from a variety of options to track their tax: by sending in pictures of their odometer or having it read at a Department of Licensing office, by using a smartphone app to track miles, or by plugging a mileage meter into their car.

“Is it feasible? Yeah,” Griffith said. “What are the policy implications of it? There are a lot. It will be complicated, which is why we’re taking our time with it.”

With no state income tax and the nation’s second-highest gas tax, Washington is unusually dependent on gas-tax revenues for highway work. But it’s not the only state looking at switching to a so-called road-usage tax.

(more on Washington’s mileage-based road tax . . . )

S;mso-bX� S#4T

![Building Angled Sm Edit 6050b8d213f1b[1]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/building-angled-sm-edit6050b8d213f1b1.Ygq5aAos3b.png?auto=format%2Ccompress&crop=focalpoint&fit=crop&fp-x=0.53&fp-y=0.23&fp-z=2&h=100&q=70&w=100)

![Building Angled Sm Edit 6050b8d213f1b[1]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/building-angled-sm-edit6050b8d213f1b1.Ygq5aAos3b.png?ar=16%3A9&auto=format%2Ccompress&crop=focalpoint&fit=crop&fp-x=0.53&fp-y=0.23&fp-z=2&h=135&q=70&w=240)