Astec Industries has released their third quarter of 2021 net sales for Q3 2021. Total sales were at $267.0 million, a 15.4% increase compared to $231.4 million for the third quarter of 2020. Domestic sales increased $20.7 million or 11.4% due mainly to pricing initiatives, stronger asphalt plant sales, incremental concrete plant sales from acquired businesses and increases in aftermarket parts sales, partially offset by reduced sales from the exit of our oil and gas drilling product lines. International sales increased $14.9 million or 29.6% primarily due to COVID-19 related temporary site closures in the prior year. International sales increased primarily to customers in Canada, Australia, Brazil and Asia.

"The adaptability and dedication of our team drove sales up during the third quarter," Barry Ruffalo, Chief Executive Officer of Astec said during the Third Quarter 2021 Earnings call. "Their ability to execute in this environment is a testament to them and to the strategies we are putting in place. I am happy to report this is the best third quarter revenue generation in the history of our company."

Backlog as of September 30, 2021 of $620.5 million increased $402.0 million, or 184.0% compared to the backlog of $218.5 million a year ago. Domestic backlog increased by 236.2% to $508.6 million while international backlog increased by 66.5% to $111.9 million.

Infrastructure Solutions increased 16.7% compared to Q32020 to $176.3 million. The company says they continue to see high demand for highway and road building products across the country.

"I am pleased with the commitment and tenacity of the Astec team as we continue to work diligently and efficiently to deliver solid results in the midst of continued global headwinds from inflation, supply chain disruptions and labor challenges," Ruffalo said. "Although for the time being, the federal highway bill has been extended for a short term versus long term period, we continue to see strong organic market activity and opportunities for growth. We are still in the early innings of our business evolution. Our record backlog, strong aftermarket parts business and growing international sales continue to demonstrate our ability to deliver value to our customers and execute our strategy. Our sales in the quarter were a third quarter record and overall results highlight the strength of the ASTEC brand, including the deep customer relationships we have invested in and grown over time. The OneASTEC business model and our strategy to Simplify, Focus and Grow continue to drive sustainable long-term value for our stakeholders."

Business Operations Update

At the beginning of the year, the company rebranded their efforts to place all companies under one umbrella. The company says the "Simplify, Focus and Grow Strategic Transformation" ("SFG") initiative is focused on implementing new business strategies and a new operating structure. This transformation was launched in late 2019 and is concentrated on aligning operations under the OneASTEC business model.

"SFG is an ongoing, multi-year program with the primary goals of optimizing our manufacturing footprint and centralizing our business into common platforms and operating models to reduce complexity and cost, improve productivity and embed continuous improvement in our processes. These efforts are considered critical to enabling us to operate competitively and support future growth, which are expected to broadly benefit our customers, partners, employees and shareholders."

In late 2020, Astec also reported that they launched a multi-year phased implementation of a standardized enterprise resource planning ("ERP") system across their global organization, which will replace much of the existing disparate core financial systems.

"The upgraded ERP will initially convert our internal operations, manufacturing, finance, human capital resources management and customer relationship systems to cloud-based platforms. This new ERP system will provide for standardized processes and integrated technology solutions that enable us to better leverage automation and process efficiency. An implementation of this scale is a major financial undertaking and will require substantial time and attention of management and key employees."

Costs incurred, during the three and nine months ended September 30, 2021, were $2.4 million and $7.7 million, respectively, which represent costs directly associated with the SFG initiative and which cannot be capitalized in accordance with U.S. GAAP. These costs are included in "Selling, general and administrative expenses" in the Consolidated Statements of Operations.

Other Challenges for Business Operations

As with other companies, Astec is experiencing the same challenges with supply chains and a tight labor market.

"I am proud of our teams resilience and ability to continue to execute in this time," Ruffalo said. "We have built traction in 2021 and as we have gone to the OneASTEC business model, we are able to leverage our supply chain more effectively to support the needs of our customers in the time they require it.

Supply Chain - Astec says they actively manage their global supply chain for constraints and volatility however, they are not immune to disruptions caused by the recent surge in global demand. Labor shortages at our vendors and logistics partners have increased lead times for certain components used in the manufacturing process. Astec says they have increased the frequency of communications with their suppliers and customers to ensure business continuity as well as anticipate and prepare for any new developments.

COVID-19 - The company insists their top priority continues to be protecting their employees and their families, customers and suppliers and operations from adverse impacts from COVID-19 by taking precautionary measures as directed by health authorities and local governments. They continue to exercise diligence to ensure the health and well-being of employees, families and the communities where they operate, while serving the needs of customers. Astec says business operations were fully operational during the third quarter of 2021.

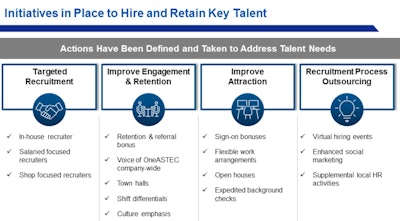

Labor - In certain manufacturing locations, Astec has experienced a shortage of necessary production personnel and increasing labor costs to attract staff in Astec Industries

Astec Industries

"Our team is core to what we do at Astec," Ruffalo said. "One of our biggest constraints is labor but we are putting initiatives in place to retain the talent we have and attract new workers to our company. We have increased our headcount by 9 percent in 2021 to help convert the backlog we do have into orders."

Steel - Steel is a major component of all construction equipment. Steel prices began increasing in the latter part of 2020. we have seen further increases in steel pricing throughout 2021 and continued increases could occur into 2022. Astec says they continue to utilize strategies that include forward-looking contracts and advanced steel purchases to ensure supply and minimize the impact of price volatility.

Highway Funding - Federal funding provides a significant portion of all highway, street, roadway and parking construction in the United States. The passaged of a substantial highway funding bill like the Infrastructure Investment & Jobs Act will influence the purchasing decisions of customers, who are typically more amenable to making capital equipment purchases with long-term federal legislation in place. Federal transportation funding under the Fixing America's Surface Transportation Act ("FAST Act"), which expired on September 30, 2020, was temporarily extended for one year through September 30, 2021 and was subsequently further extended through December 3, 2021. Astec believes a multi-year highway program (such as the FAST Act) will have a positive impact on the road construction industry and allow our customers to plan and execute longer term projects.

"Customers view this bill as a long term tail wind but we are not waiting around for the bill to be passed," Ruffalo said. "During the third quarter, we started to see benefits from the initiatives we have put in place. I am encouraged by the actions our team is taking. We remain well-positioned to capitalize on the positive customer sentiment."