If you are planning to replace certain equipment and have a potential tax balance, or the availability of carryback claims, you better find out where you stand and act now!

Many changes are taking place in the equipment marketplace. These include:

Add it all up and it spells trouble if you delay your decision to order that new piece of equipment. Even now, you may have trouble getting a delivery date that will allow you to qualify for the bonus depreciation benefit.

Manage your taxes

What really makes the 2004 acquisition meaningful is the bonus depreciation. If business is good and you would like to defer paying taxes on 2004 income, using the bonus makes sense, especially if you are already in the “buying mode”. Using a 35% tax bracket, you can pocket approximately $15,000 by purchasing in 2004 and getting the unit placed in service by the end of the year.

One good reason to push off that tax bill is to avoid the estimated taxes that go with it. If you have been living through the recession and have not been paying taxes, and you will pay taxes for 2004, you will need to pay the tax plus duplicate that amount in the form of estimated taxes for 2005. If you can conserve cash and give yourself some breathing room by taking advantage of the bonus depreciation, that may not be a bad idea. Keep in mind the tax bill will catch up with you in the future, but at least you will have had time to rebuild your reserves in the meantime.

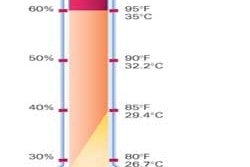

The depreciation chart reflects how you repay the bonus you take in 2004. See how tax deductions in the subsequent years are reduced. These differences can be substantial for those of you with large equipment fleets. Further tax planning and fleet management is a must to mitigate this potential exposure.

Used is in demand

Because demand for new equipment is moving upward, the same is happening for good used equipment. Dealers are now holding on to used units and getting their price.

Contractors should be experiencing the same thing.

Selling or trading in a unit should no longer be a bad experience — another reason not to hesitate about a potential purchase. In fact, those of you thinking of only buying late-model used equipment because you can get it at discounted values may be in for a surprise. Yet another reason to explore purchase of a new unit.

When you boil it all down, if you plan to replace equipment in the next 18 months or so, it pays to buy now to have access to the bonus depreciation (if you can use it). It pays to buy now if you believe interest rates are on the rise. And it pays to buy now if you believe there are no longer any “deals” in the used market. Please note that the information in this article is provided primarily for educational purposes. It should not be construed as tax advice or as a promise of potential savings or reduced tax liability. Contact your tax professionals for specific tax advice.