By Ralph Petta, President and CEO, Equipment Leasing and Finance Association

With the approval of new rules for lease accounting by the Financial Accounting Standards Board in 2016, lessees are considering how the new standard will affect them. Many of the lease accounting changes are relatively neutral and should not impact the ability of companies to acquire productive equipment to operate and grow their businesses. The primary reasons to lease equipment will remain intact under the new standard, which is known as Accounting Standards Codification Topic 842 (ASC 842) and will generally take effect in 2019.

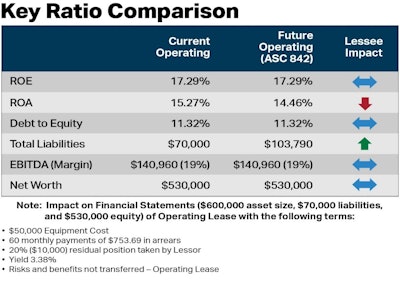

One of the key changes is that leases previously classified as operating leases under current accounting standards will now be capitalized and thus reported on corporate balance sheets. With the changes in balance sheet reporting, some financial statement ratios may be affected.

Financial Statement Ratios

A financial statement and its corresponding ratios are a key indicator of a company’s financial health and are relied on by lenders and reviewed by potential investors, so it is important to understand any changes to financial statement ratios under the new standard.

Under ASC 842, operating leases will no longer appear simply as a table of future payments in the footnotes; they will appear as a “right-of-use” asset and an offsetting lease liability on the balance sheet. We understand from credit agencies that the lease liability should be considered a non-debt type of liability; that is, an “other” operating liability. As a result, the return on assets (ROA) financial ratio is likely the only ratio that will change, although total liabilities will increase. Other financial ratios should remain unchanged. It is expected that there should be minimal impact on debt covenants and no impact on debt limit covenants. Overall, the new rules should have no impact on the profit and loss (P&L), or income statement because the lease-related costs should remain the same.

To illustrate the changes in the key financial ratios, let’s examine the difference between leasing a $50,000 piece of equipment under the current standard, ASC 840 (formerly known as FAS 13), and the new standard, ASC 842. Looking at the methods for calculating typical financial ratios, you can see that some ratios are unchanged (blue sideways arrows), while some decline (red downward arrow) and some increase (green upward arrow).

- ROE – Return on Equity - No change. ROE is calculated as Net Income divided by Equity. This ratio is unchanged because there’s no change in the lessee’s lease expense for an operating lease from ASC 840 to ASC 842. Both are straight lined, and there should be no change in equity as a result of the accounting change.

- ROA – Decline. ROA is calculated as Net Income divided by Assets. While there is no change in Net Income because the lessee’s lease expense is straight lined under both guidelines, the amount of Assets reported do increase under ASC 842 since the operating lease will be capitalized on the balance sheet. An increase in the denominator (Assets) will thus reduce the ROA ratio.

- Debt-to-Equity – No change. While the lease liability is on balance sheet under ASC 842, the lease obligation is considered an “other” liability but is not classified as debt. Since there should be no increase in debt, there should be no change to the ratio.

- Total Liabilities – Increase. The lease liability is now on balance sheet under ASC 842 resulting in an increase in liabilities.

- EBITDA and EBITDA margin – No change. EBITDA is calculated as Earnings Before Interest, Taxes, Depreciation and Amortization. The EBITDA margin is calculated as EBITDA divided by revenue. There is no change to the EBITDA or the EBITDA margin because the lessee’s rent in an Operating lease is recorded as lease expense under both the current and future guidance.

- Net Worth – No change. Net worth is unchanged since equity is unchanged.

Additional resources

There are many reasons to lease equipment — managing cash flow, preserving capital and available traditional lines of credit, obtaining flexible financing solutions, managing tax liabilities and avoiding equipment technological obsolescence, just to name a few — that businesses will continue to enjoy with reporting leases on balance sheet. For more information and resources on ASC 842, including FAQs, 8 Steps to Help Transition and infographics, visit http://EquipmentFinanceAdvantage.org/newLAR.cfm.

For more information on equipment financing, please visit www.EquipmentFinanceAdvantage.org.

Disclaimer: The information in this document is a summary only and does not constitute financial advice. Readers should obtain their own independent accounting advice that takes into account all relevant aspects of a particular lessor’s or lessee’s business and products.

©Equipment Leasing and Finance Association 2017. Reprinted with permission.