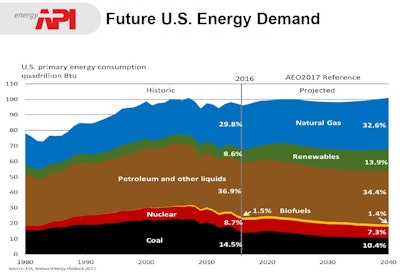

The U.S. Energy Information Administration (EIA), part of the U.S. Department of Energy, projects there will be an approximately 5% to 6% increase in overall energy demand in the U.S. between 2016 and 2040. Kyle Isakower, vice president, regulatory and economic policy for the American Petroleum Institute, describes this as “very, very low.”

Energy segments expected to gain in market share include natural gas and renewables, while petroleum, nuclear and coal will shrink slightly. “The amount of petroleum delivered is relatively flat,” said Isakower. However, this doesn’t mean other forms of energy will be taking over. “Even though petroleum shrinks in market share, it’s still the predominant energy source for our nation as far out as 2040.” More than 67% of U.S. energy demand is currently met by petroleum and natural gas, and is forecast to remain on pace at that level.

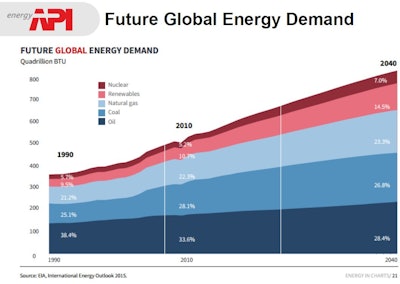

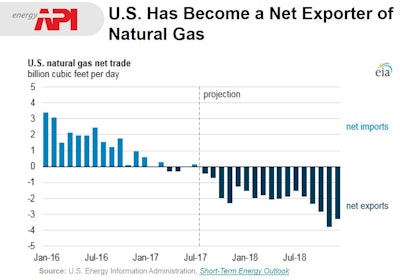

“Keep in mind energy is a global commodity,” he continued. “Natural gas is becoming a global commodity with the advent of liquified natural gas (LNG), which you can put on tankers and ship around the world… As such, instead of the regional markets for natural gas that we currently see, it’s becoming more of a global market.”

Production Gains Lower Costs and Provide Investment Incentives

The U.S. is increasingly getting more of its energy from domestic sources, nearly doubling its production of crude oil production since 2008. “We are producing a lot more of our energy here at home,” Isakower said. “Not only have we been growing over the last eight years or so, but we’re going to continue to grow.”

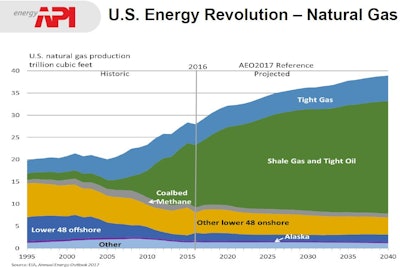

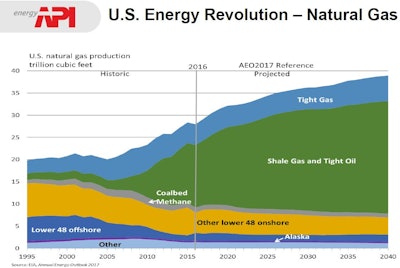

The U.S. is currently on track to reach up to 10 million barrels a day production by the end of 2017, which would put the country on par with Saudi Arabia and Russia as one of the largest oil producers in the world. “Not only are we going to hit 10 million barrels a day, but we’re going to continue at 10 million barrels a day for the next 20 years and possibly beyond,” Isakower indicated. “The U.S. is not resource bound. We can continue to produce at record-high levels for two decades and more… [with production] coming predominantly from shale.

“The resource here for natural gas is extremely large,” he added. “Over a 100-year supply.”

Growth in production stems largely from advances in shale mining over the last 10 to 15 years that have dramatically cut costs. The combination of existing technologies – hydraulic fracturing and horizontal drilling – into a single operation allows for significantly greater yields at lower cost.

According to Isakower, this helps the U.S. in a number of economic ways. “First of all, it lowers consumer cost. Having all that additional supply of both oil and natural gas puts downward pressure on price,” he pointed out. A stable, affordable supply of natural gas also incentivizes manufacturing, along with investment in the mining industry. “Because we are producing more, we are investing more. We’re hiring more people. That spurs more economic growth.”

Surpluses of crude refined products and natural gas also allow the U.S. to export what it doesn’t use, helping reduce the trade deficit.

Isakower cited an environmentally-related side benefit, as well. Because the price has dropped substantially, the utility industry is moving away from coal to natural gas – with its lower carbon footprint – for economic reasons. “Now that it is both low and non-volatile [in price], a lot of the utilities are moving toward natural gas, and that has the added benefit of reducing GHGs (greenhouse gases),” said Isakower. “We’re actually near 30-year lows in our country with GHG emissions from the power sector, and 60% of that decrease… is actually coming from natural gas use rather than renewables use.”

Opportunities and Obstacles

The U.S. is on a stable path on the energy supply front, with high stocks of crude oil and gasoline on hand to shield the country against market shocks. Where it needs help is in the area of infrastructure.

According to Isakower, the limiting factor in the growth of shale production will be a lack of required infrastructure in shale-rich regions. “As production increases in these areas, we need more infrastructure so we can get oil and gas to the places that we need it. The federal government under this administration is certainly supportive of more infrastructure,” he stated, “but there is still a lot of local and in some cases state opposition to energy infrastructure.”

As an example, he cited the State of New York, which has denied a number of permits for natural gas pipelines that would supply fuel throughout the Northeast. “New England is an area that historically uses a lot of oil and coal for energy development and for heating. Frankly, there are a lot of utilities that would prefer to switch to natural gas," said Isakower. The obstacle is New York State won’t issue permits to allow the necessary pipelines to pass through the state.

“From an economic standpoint, that’s a huge economic benefit to the nation," he added.