Here we stood at the end of September and still not much was happening in the construction markets. If you're in certain sectors, you're probably busy, but still scrambling for work to carry you over the winter.

A rental client of mine in a major Midwest city recently entertained 50 contractors. He took it upon himself to speak to each one personally to gauge their activity level for the winter, and thus his own winter activity. Most of the contractors mentioned they were currently busy, but didn't have much work scheduled for the winter months. I suppose that means they have no work booked to carry them over. However, work may appear -- just as it does now -- on short-term notice.

Market improvements ahead?

The end of September also brought about the annual AED/Lawson Executive Forum in Chicago, which is designed to help construction industry executives and dealers plan for the remainder of 2010 and into 2011. As such, there were economists and industry analysts on the program to discuss current and projected construction and related dealer and rental company activity. (I always thought construction company executives would find this program interesting, and after the content this year, I continue to believe so.)

In the end, the speakers concluded that the outlook for the second half of 2010 and 2011 is improving. (Good grief, some encouraging news!)

The keys to market improvement for the rest of 2010 and full year 2011 will, of course, be financing availability, and the ability to get any unused stimulus money into the right programs. Housing starts are projected to hit 650,000, with an outlook of perhaps 900,000 possible for 2011. Non-residential construction is expected to stabilize in 2011. All in all, a mid-single digit gain is expected for 2011 from combined residential and non-residential activity. And 2012 is expected to see vast improvements.

If we can believe these projections, contractors have to start reviewing their equipment needs and make adjustments as necessary. It was interesting to hear the industry panel conclude that rental was going to be the preferred alternative to purchasing equipment for the near future. Used equipment purchases came in second, leaving new equipment purchasing in third place.

Equipment availability and cost increases

Tier IV discussions filled a major section of the program. It appears that contractors and rental companies may be making a run on existing equipment inventory to avoid the price increases associated with Tier IV units. It was also pointed out that the service requirements for equipment using Tier IV technology would require training and diagnostic tools only available through dealers at this stage of their development.

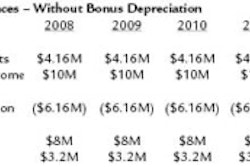

Another point that was continually made is that manufacturers are very lean on inventory, and if there is a real need for a certain type of equipment, the purchase better take place sooner rather than later. To help with this process, the bonus depreciation and Section 179 programs have been extended to cover purchases made in 2010 and 2011. Section 179 write-offs were also increased to $500,000.

If you recall, the bonus covers new equipment purchases, while Section 179 covers both new and used purchases. This is quite an opportunity if you have taxable income to shelter. If you don't, then maybe rental is the way to go.

The way I see it, contractors are going to be reluctant to make financial commitments to purchase equipment, and are more likely to rent or purchase low-hour used equipment to add to their fleets. As a result of increased rental activity, rental rates will increase and rental companies will work with the customers that pay. Tier IV equipment will likely command premium rates, since demand will be high to meet bid requirements for federal jobs. Contractors may be wise to work out deals with rental houses as a "preferred customer" to ensure a steady supply of equipment when needed.

If you made it this far, you are a survivor who can make it to 2012's recovery period. To do so, however, requires cash flow planning to ensure you don't take on more business than you can handle, and thus expand your business into bankruptcy. In short, don't blow it now.