We have all heard about how the economy has taken its toll on most businesses. Probably the hardest hit has been the manufacturing sector. In such uncertain economic times, Contractors can benefit from equipment leasing, a financing practice that has been around since 2000 B.C.

Leasing equipment can help your business survive these uncertain times and also prepare you for the next boom. Leasing helps you to manage your cash flow, guards against obsolescence, increases financial flexibility and may reduce your tax burden. These advantages can apply to most any equipment, from a blast furnace to a new computer system.

Why Companies Lease

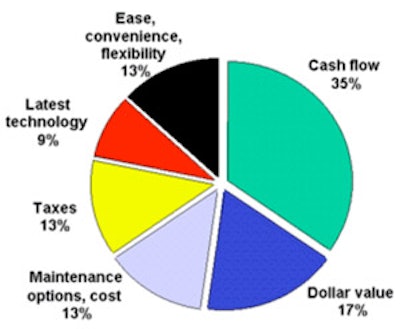

The Equipment Leasing Association surveyed small and medium size businesses, and asked them to list reasons of why they decided to lease rather then buy equipment. (Graph A)

- 35 percent stated Cash Flow as the primary factor - This may be especially important in the commercial contractor industry.

- 17 percent sited Dollar Value - Leasing offers fixed rate financing so payments remain the same throughout the term of the lease regardless of interest rate fluctuations.

- 13 percent said they preferred the Convenience and Flexibility - There are endless ways to configure a lease. For example, it may take months for your new equipment to operate at peak efficiency, so a lease may be set so there are no payments or smaller payments for the first several months. If your business is seasonal, the lease can be structured with variable payments.

- 13 percent claimed Taxes were the main attraction. - A lease can be structured as an operating lease so payments are totally tax deductible and the lease obligation remains off balance sheet.

- 13 percent of the companies preferred Maintenance Options - Maintenance costs can be included in the lease, therefore reducing maintenance cost variations.

- Nine percent felt leasing helped them stay abreast of Latest Technology - If the equipment is no longer useful to your business at the end of the lease, the lessee may choose not to exercise the lease-end purchase option.

There are also other considerations that may be pertinent to the commercial industry:

- Expanded credit availability - Leasing normally doesn't impact your bank credit relationship, preserving your banks credit availability for short-term credit needs. Also, if a lease is structured as an operating lease, the lease obligation may not affect leverage ratios in bank loan agreement covenants.

- Section 179 of IRS Code - This rule allows total annual deductibility of up to $108,000 annually for qualified equipment purchased or leased through a capital lease. The one catch is that the company's total equipment expenditures cannot exceed $200,000 for the current tax year.

- Circumventing budget restrictions - Many companies consider a lease an expense item and not requiring a capital budget review process.

Types of Leases

1. Operating Lease - This is the typical "Off Balance Sheet" lease. It is typically a shorter-term lease and frequently is on equipment that there is a high likelihood of being jettisoned when the lease ends - high tech equipment, computers and high-use copiers. It answers four criteria as established by Financial Accounting Standards Board (FASB):

1) Ownership of the property does not automatically transfer to the lessee at the end of the lease term

2) The lease does not contain a bargain purchase option

3) The lease term is less then 75 percent of the useful life of the equipment

4) The present value of the lease payment is equal to less then 90 percent of the cost of the equipment.

Under this scenario, the payments are an expense and no asset or liability is recorded on the balance sheet. The accounting profession is playing with these standards; within the next five years there may be no off balance sheet transactions. If your lease meets these standards, then the payment can be expensed. Although, if your financial statements are not audited, the IRS has a looser definition of what constitutes an operation lease. Typically they will allow this treatment for any lease with at least a ten percent purchase option.

2. Capital Lease - This is also typically called a finance lease. It is an asset and liability issue and the lease typically has a bargain purchase option of $1.00. Companies who use this type of lease will do so for a variety of reasons of which we have covered earlier, primarily for cash flow management, flexibility, fixed payments and tax deductibility.

3. Sale/Leaseback - This is a situation where a company has purchased and is using the equipment, which they then sell to a leasing company, which in turn charges rent for the usage. The main reason for doing a sale/leaseback is so that a company, which has recently paid cash for a piece of equipment, realizes that they could have put the cash to better use.

4. Trac Lease - This is for vehicles only and does not pertain to all industries. It is a lease whereby the lessee guarantees the lessor that they will not suffer a loss on the residual buyout at the end of the lease. Typically these types of leases are done with semi-tractors and trailers.

After deciding that your company wants to lease some equipment, you have to decide where to go to for a leasing company. There are several different categories of lease companies as well as the size of the transactions that companies work with. A micro-ticket company only works with leases between $1,000-$25,000, small ticket is between $5,000-$250,000, mid-ticket is $250,000-$5 million, and large ticket is more than $5 million.

Types of Finance Companies

1. Bank Affiliated - These frequently can provide very competitive rates. They are also good for relationships especially if it's your bank and you have open credit availability. Not so good if you are maxing on your conventional credit or it's a competing bank and also not so good if you are buying equipment for your Dallas operation which will be making the payments because banks can be very territorial. Many banks maybe limited by being able to do business in the state that you are in and not at another company location that is out of state.

2. Independent - They can offer the greatest flexibility, will do almost any type of equipment, and can offer very competitive rates, although not usually as low as the banks or the captives.

3. Brokers - Generally considered the most expensive form of leasing. They will turn a transaction around and sell it to an Independent leasing company or bank affiliated company. They need to get their approval in order to get the transaction completed. Can typically get "bruised" credits approve through higher risk sources.

4. Captive - These are owned by the equipment suppliers and can provide very low rates because of their familiarity with the product. They also may use lease as a "loss lead" to move equipment. They typically can only finance their products and will not lease products from multiple manufactures. Some independent leasing companies may become a manufacture's "Captive" finance company when the manufacture "buys" down the rate, making it cheaper for the end customer.

As a business owner or manager leasing may be a good alternative for when you have to upgrade or expand your plant's equipment. Leasing has become a way for any size company to take advantage of the competitive forces that are at work in the financial community and get your equipment financed in a way that makes the most sense for management and the shareholders. In the end, you will want to seek out and talk to several different sources before you decide on a finance company that you will want to work for now and in the future. Many companies choose a lease/finance company because they may have the cheapest rate. Sometimes rate may not be the most important factor, it could be flexibility, ease of working with the finance company, or a company's willingness to work with you in the future. Whatever you decide, make sure you feel comfortable with the people that you are working with, because in the end, they will be the ones that will be able to help with your company's future expansion plans.

|

ABC Foundry - A Real World Example - ABC Foundry needed to upgrade its melting equipment to meet the increased demand for truck replacement parts that they are projecting to have in the next several years. The key equipment included two 600kW, 600HZ MK-8 Power Supplies - 480 V input; two sets of High Conductivity Water Cooled Drop Bars; two sets Water Cooled Power Leads; one 2,200# Steel Frame Furnace, and one 3,000# Steel Frame Furnace; one Nonferrous closed pressurized water cooling system; one 10-ton electric crane; one two-ton electric crane. Total cost, $340,000. Management considered the options of paying cash, bank loans and leasing. Spreadsheet 1 - Lease vs. Cash For ABC foundry, due to its overall leverage, cash was not a viable option. Yet even if it had the cash available, paying cash may not have been the right decision. According to a Dun and Bradstreet survey, the average company earns 15 percent on the money that is left in the business. For argument sake, even at 10 percent the company is still better off leasing. Furthermore these examples don't include the positive tax consequences of writing off the lease payments. Leasing also provides a hedge against inflation, keep cash available for tougher times. Paying cash requires paying for the equipment before it is productive. Spreadsheet 2 - Lease vs. Loan The management of ABC Foundry quickly dismissed cash as an option, then considered an equipment loan from bank. The company had $300,000 available on its $500,000 credit line, and the bank was willing restructure the relationship to include the equipment loan with a 20 percent down payment. The terms were favorable but the net result would stretch the company's bank credit availability. The bank offered a five year 9 percent loan with a down payment of $67,484, the amount financed would have been $269,934; monthly payments would be $5,605. After considering the alternatives management decided to lease. This allowed them to conserve the cash required for the bank loan down payment, and preserve the company's bank borrowing capacity to support the company's anticipated growth. The lease also gave them greater the tax benefits. This is but one example of how leasing became an important ingredient of a capital expenditure program. Although leasing isn't always the answer, leasing is one of the most flexible means of equipment financing. Leasing comes in all shapes and sizes and can make sense for the small and large equipment of all types. Here is a brief overview of types of leases: |