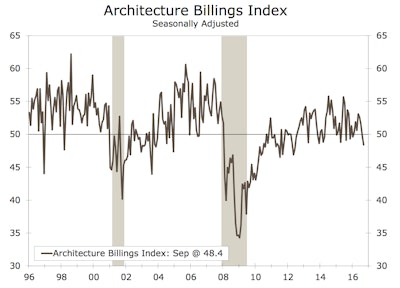

For the first time since the summer of 2012, the Architecture Billings Index (ABI) posted consecutive months of a decline in demand for design services. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to 12 month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI score was 48.4, down from the mark of 49.7 in the previous month. This score reflects a decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.4, down from a reading of 61.8 the previous month.

According to Wells Fargo Securities, the score is the lowest since April 2015. The three-month moving average also slipped during the month, falling 1.4 points to 49.9 in September. Weakness was broadly based across segments, with residential (48.8), institutional (49) and mixed billings (49.8) all posting contractionary readings, while commercial/industrial remained just above the threshold at 50.4.

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “But this drop-off in demand could be continued hesitancy in the marketplace to move forward on projects until the presidential election is decided. The fact that new work coming into architecture continues to slowly increase suggests that billings will resume their growth in the coming months”

Wells Fargo Securities points out that on a regional basis, billings in the Northeast and West both recorded three-straight monthly scores below the breakeven threshold, while the South and Midwest remained in expansion territory.

According to AIA, the South registered at 53.4 on the Index, the Midwest at 50.1, the West at 49.5 and the Northeast at 44.

The project inquiries index was at 59.4 for the month and the design contracts index was at 51.4, according to AIA.

The regional and sector categories are calculated as a 3-month moving average, whereas the national index, design contracts and inquiries are monthly numbers.

The weak September billings score is consistent with lackluster readings in construction starts and the Dodge Momentum Index (DMI), which delivered mixed readings earlier in the year, according to Wells Fargo Securities. For the DMI, which measures nonresidential projects in planning, the 4.3% decline in September follows five months of gains but is also likely payback from the influx of large projects in August. Notwithstanding the monthly weakness, the trend continues to suggest upward momentum. Indeed, the commercial/ industrial component of ABI remained positive (middle graph).

Construction starts as reported by Dodge Data & Analytics fell 2% in September, following a 22% jump in August. Here again, the nonresidential building component advanced during the month, increasing 5% to a $282.3 billion annual rate, Wells Fargo Securities reports. The starts release also noted volatility due to the start of large projects. September’s increase is marked by a jump in office starts, reflecting two noteworthy projects, 3 Hudson Yards ($2.0 billion) and One Vanderbilt Tower ($1.5 billion). Given the start of these two sizeable projects, we will likely see some pullback in the nonresidential component in the coming month. Institutional also rose during the month, increasing 8 percent.

Activity in nonresidential starts is important to note as data from the series is used as a key input in the monthly value of construction put in place. Speaking of the value of nonresidential construction put in place, we continue to expect private nonresidential outlays to increase in the mid- single digits this year and advance around 4% in 2017. Much of the gains this year continue to be concentrated in commercial building, which is up more than 9% year over year on three-month moving average basis (bottom chart). On the back of higher education, education building spending continues to lift institutional outlays, while the trend in transportation, communication and manufacturing remain weak. On a year-ago basis, residential outlays are up, but spending on single-family units fell 1.5% in August, according to Wells Fargo Securities.