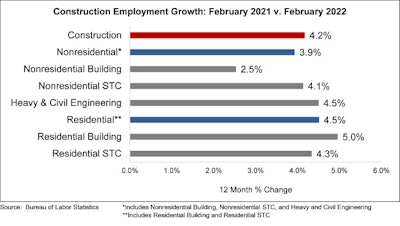

The construction industry added 60,000 jobs on net in February, according to data released by the U.S. Bureau of Labor Statistics. Overall, the industry has recovered virtually all (99.0%) of the jobs lost during earlier stages of the pandemic. The labor-force participation rate ticked higher, as wages in construction and the overall economy have turned up sharply, but the unemployment rate dropped to a low for this business cycle.

“All segments of construction added workers in February,” added Ken Simonson, chief economist at the Associated General Contractors of America. “However, filling positions remains a struggle, as pay is rising even faster in other sectors.”

Average hourly earnings for “production and nonsupervisory employees” — largely, hourly craft workers, in the case of construction — increased 6.0% from February 2021 to last month. It was the steepest 12-month increase since December 1982.

Simonson points out that the construction-industry average of $31.62 per hour for such workers exceeded the entire private-sector average by 17%. Nevertheless, average wage growth across the private sector climbed even more in February than in construction — 6.7% year-over-year — so competition for workers has intensified. The month's 678,000 increase in total nonfarm payrolls was the largest increase since July, according to analysis of the monthly employment data by Wells Fargo Economics.

"February's report showed further signs of workers stepping back into the jobs market and making it somewhat easier for businesses to hire," said Sarah House, senior economist with Wells Fargo Securities. "The labor force participation rate ticked up to 62.3%."

Construction was among what Wells Fargo calls a few "major standout sectors for job growth in February."

Nonresidential construction employment increased by 29,400 positions in February, with all three subsectors experiencing growth, and is up 3.9% over the past 12 months. That included 19,900 more employees among specialty trade contractors, 7,300 at heavy and civil engineering construction firms, and 2,200 working for general building contractors.

Residential-sector employment is up 4.5% over the past 12 months, adding 31,000 in February including 24,300 at specialty trade contractors and 6,700 employed by homebuilders and multifamily general contractors.

The construction unemployment rate fell to 6.7% in February. The number of unemployed jobseekers with construction experience shrank by 26% over the past year. Unemployment across all industries declined to 3.8%, down from 4.0% in January.

Associated Builders and Contractors

Associated Builders and Contractors

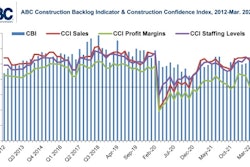

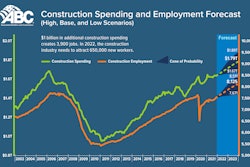

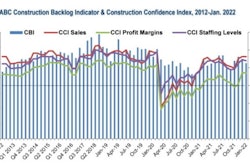

“Evidence indicates that contractors have had a somewhat easier time filling available positions recently,” said Basu. “There are also indications that supply chain issues have improved slightly, though the Ukraine/Russia war may create new issues on that front. With demand strong and the supply side of the economy in repair, 2022 is setting up to be a strong year for contractors. At some point, federal infrastructure dollars will begin to flow more freely, and that will help support additional contractor backlog, which declined to 8.0 months in ABC’s latest Construction Backlog Indicator report.

“But there remain many reasons for concern,” said Basu. “Despite stepped-up federal investment in infrastructure, overall federal spending will be down sharply in 2022, creating substantial fiscal drag. Inflation has been draining households of accumulated savings and could trigger rapid slowing in consumer outlays. Interest rates are poised to rise as the Federal Reserve readies itself to deal more forcefully with what has turned out to be non-transitory inflation. Elevated oil prices are likely already doing damage to the economy, damage that is not yet apparent in key macroeconomic indicators. Elevated oil and other prices are also driving the cost of delivering construction services higher, which could result in the postponement or cancellation of some projects.”