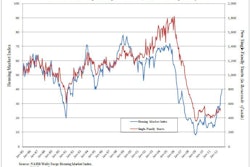

Since the peak in early 2006, the median price of a U.S. home is down by a third and is expected to fall an additional 1% from the beginning of this year through 2013.

Of the 384 largest housing markets measured by real-estate data company Fiserv, 69 have seen home prices fall more than the national average. 24/7 Wall St. reviewed the markets with the worst home-price declines and identified markets where the median price has not improved as of the first quarter of 2012. The 10 worst are housing markets that have fallen at least 55% and have yet to recover.

While the drop in home prices in these markets has slowed, the local economies have been devastated. July unemployment rates in the worst housing markets were all above the national rate of 8.1%. Eight of the 10 have rates of at least 10%, and five are above 12%.

And continually depressed home prices also have led to unusually high foreclosure rates in these markets.

(More on ten cities that can't turn housing around . . . )