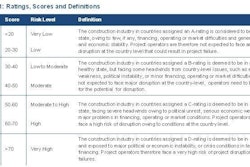

According to the latest update of Timetric’s Construction Risk Index (CRI), the overall level of risk facing the global construction industry eased marginally in Q2 2015. An upturn in risk in emerging markets was offset by a slight decline in risk facing the construction industry in advanced economies. The risk score for emerging markets rose from 48.38 in Q1 2015 to 48.73 in Q2 2015, while for advanced economies it dropped from 33.37 to 32.95 over the same period.

The CRI, which is updated on a quarterly basis, provides an analysis of current conditions and a forward-looking assessment of general and specific risks that could prevent projects from being executed, result in major disruptions to projects or ultimately lead to project failures. A total of 29 out of the 50 countries in the CRI recorded improvements in their risk profiles in Q2, notably the Netherlands and Sweden, where construction activity is expanding at a healthy pace; while 20 countries posted a deterioration. Sweden remains the lowest-risk country in the CRI, but the Netherlands was the best performer in Q2 update, with its score rising 3.19 points, moving it to 18th place in the rankings. Greece was the worst hit, with its economy falling back into recession and a deadlock in negotiations between the new government and the EU-IMF over the bailout program.

Market risk improved marginally in the Q2 update. However, some key markets - notably France, Italy, Austria and Portugal - remain in trouble, while others such as the UK, the Netherlands, Sweden, Germany and Ireland are picking up.

Economic risk has continued to rise steadily, reflecting the weak economic performance of some of the major countries, such as Russia. Moreover, the low oil prices, even if they are set to pick up in the second half of 2015, will still remain relatively low, greatly impacting oil-dependent economies. Financial risk has edged up marginally, part of this reflecting the fragility of a number of emerging markets reliant on revenues from exports of oil and other commodities, prices for which have fallen.

According to Sina Zavertha, economist at Timetric’s Construction Intelligence Centre (CIC), “Political risk is also picking up in key emerging markets around the world, greatly undermining investor confidence, and in many cases compounding economic fragility. Notably, the ongoing diplomatic conflict between Russia and the West over the former’s intervention in Ukraine is continuing to take its toll across the region.”