The Federal Reserve raised interest rates for the first time in almost a decade, a widely telegraphed move that Chair Janet Yellen said would be followed by “gradual” tightening as officials watch for evidence of higher inflation.

The Federal Open Market Committee unanimously voted to set the new target range for the federal funds rate at 0.25 percent to 0.5 percent, up from zero to 0.25 percent. Policy makers separately forecast an appropriate rate of 1.375 percent at the end of 2016, the same as September, implying four quarter-point increases in the target range next year, based on the median number from 17 officials.

"The one phrase that I think is notable is that the committee is confident that inflation will rise, and that was the key criterion that changed," said Guy LeBas, managing director and chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia.

“The committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate,” the FOMC said. “The actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.”

(more on the Fed rate hike . . . )

Some Likely Results of the Fed Rate Hike

Source: USA Today

Doug Duncan, chief economist of Fannie Mae, the giant government-sponsored funder of mortgages, expects this week's Fed hike of a quarter of a percentage point to have virtually no immediate impact on Treasury or mortgage rates, noting markets already have priced in the move. Assuming the Fed raises its rate by a percentage point over the next year, Duncan expects 30-year mortgage rates to drift from 3.9% to 4.1% during the period.

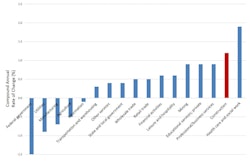

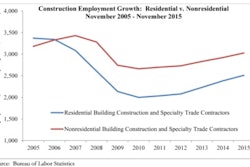

Construction spending is up a healthy 10.7% this year as manufacturing, hotel and office building takes off. Slightly higher borrowing costs for projects is unlikely to alter that dynamic.

"If anything, a move by the Fed might provide a signal to nervous investors that the Fed is confident about the strength of the U.S. economy," says Ken Simonson, chief economist of trade group Associated General Contractors. "Higher rates could also attract more foreign investors in all types of assets, including real estate."

For manufacturers looking to expand for the fast-growing auto and aerospace sectors or office developers serving Millennials moving to cities, a small rise in borrowing costs will barely register, Simonson says. But the hotel- and warehouse-building craze may be winding down, he adds, and a modest rise in rates could discourage some activity in those industries.

(more on the effects of the Fed’s rate hike . . . )