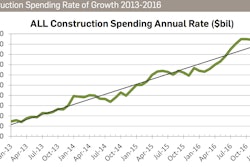

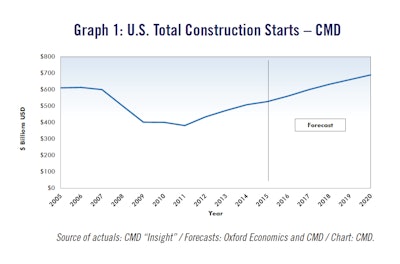

Construction starts in the United States are expected to increase 6.5% and total more than $560 billion in the coming year, according to CMD’s latest quarterly forecast report. An overall recovering economy, including wage and employment growth, increased state and federal spending on infrastructure projects and an improved investment outlook in non-residential construction are contributing to the forecast.

The report, which combines CMD’s proprietary data with macroeconomic factors and Oxford Economics econometric expertise, shows year-end growth came in slightly below expectation. A weaker fourth quarter depressed construction activity, leading to total construction starts growth of 3.7% in 2015. A disappointing decrease in nonresidential starts of -3%, were offset by positive growth of 6.3% in residential construction starts and 10.8% growth in engineering/civil construction starts.

“At an annual growth rate of 3.7% compared with 2014’s 7.4%, the accelerator was eased on total U.S. construction starts in 2015,” said Alex Carrick, CMD chief economist. “The nonresidential building category underperformed, while residential work maintained a steady upward path and engineering starts surged.”

According to the report, the demand for single-family homes will exceed the demand for multifamily homes and drive the performance of residential starts over the next several years. Additionally, industrial starts, which increased greatly in 2014 and 2015, will be blunted by depreciation in the U.S. dollar. Medical starts, which increased 8.6% in 2016, will settle around 5% annual growth from 2017 to 2020 as they ride the crest of an aging population.

“Overall starts in 2016 will pick up the pace to 6.5%, with cyclical improvement in jobs and incomes heating up residential demand, nonresidential building work beginning to break loose, however, the engineering/civil category projects to slow down after such a strong prior year,” stated Carrick.

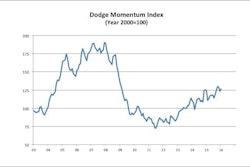

Graphs showing Q1 2016 construction industry predicted growth in each sector