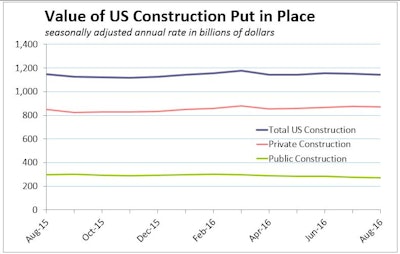

For the second consecutive month, total construction spending pulled back in August. Both changes, the 0.3% slip in July and 0.7% in August (to $1.142 billion) are within the margin of error of the estimates by the U.S. Census Bureau of the Department of Commerce. The loss of spending momentum was broad based with lower readings in private residential and nonresidential sectors, and a continuation of the downward public spending trend.

The larger trend continues to show growth. Total construction spending for the first eight months of the year is up 4.9% compared to same period in 2015.

“While demand for construction remains robust, it is no longer growing like it was earlier this year,” said Ken Simonson, chief economist with Associated General Contractors. “There is little doubt that new public-sector investments in our aging infrastructure could help reinvigorate demand for construction.”

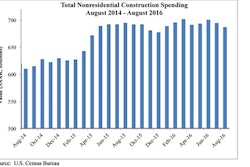

Private nonresidential construction spending decreased 0.4% for the month but is up 4.2% year-to-date. The largest private nonresidential segment in August was power construction (including oil and gas pipelines), which declined 1.5% for the month but is up 2.9% year-to-date. The next-largest segment, manufacturing, dropped by 1.4% for the month and is down 7.4% year-to-date. Commercial (retail, warehouse and farm) construction decreased by 2% in August and climbed 6.9% year-to-date. Private office construction climbed 2.3% for the month and 28% year-to-date.

Private residential construction spending dropped by 0.3% between July and August 2016, but is up 1.4% year to date. Spending on multifamily residential construction increased by 2.4% for the month and remains up 13.9% over the first eight months of the year, while single-family spending fell 0.9% from July to August and is down 1.5% year-to-date.

Public construction spending declined 2% from a month before and dropped by 8.8% year-to-date. The biggest public segment—highway and street construction—decreased by 2.9% for the month and is down 8.3% year-to-date. The other major public category—educational construction—fell by 0.4% in August and dropped 0.8% year-to-date.

“Anticipation for the continuation of the U.S. economic expansion and a low-interest-rate environment supports our outlook for moderate construction spending gains in the quarters ahead,” according to Wells Fargo Economics Group analysis of the Commerce Department numbers.