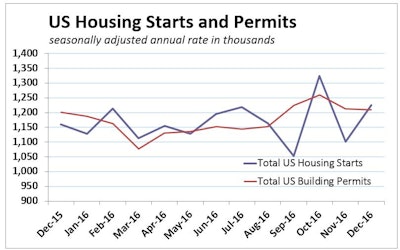

Thanks to an outsized 57.3% surge in the volatile multifamily segment, total U.S. housing starts rose 11.3% in December to a 1.226-million-unit seasonally adjusted annual rate.

“Although the strong reading is welcome, the level of starts looks to be bit exaggerated, especially as we are in the seasonally slow period of the year and swings in the data due to the seasonal adjustment process and weather distortions play a larger role in the headline reading,” according to the Wells Fargo Group’s analysis of monthly estimates from the Census Bureau and the Department of Housing and Urban Development.

The three-month moving average shows starts are up a more moderate 5% in December, with single-family starts eking out a 0.6% gain and multifamily increasing 16%.

Permits, which tend to be less volatile, fell 0.2% in December but grew 1.9% on a year-over-year basis.

The annual average for permits is running ahead of starts, suggesting increased housing construction in the coming year.

“In previous publications, we have written about the shift in construction toward less expensive homes, which is a welcome sign following the dearth of activity in the lower-priced home segment as many investors converted units into rentals,” Wells Fargo notes. “We suspect some of this activity will cool as the recent spike in mortgage rates following the election curtails overall activity.”

December mortgage-purchase applications are already showing some of the strain of higher mortgage rates, declining in December from a two-year high.

Multifamily starts’ 57.3% December leap to a 431,000 unit-pace is balanced in part by a 9.0% drop, to a 393,000-unit rate, in permit issuance.

“The trend in multifamily starts seems to be unrelenting; however, we expect some payback in the coming months,” Wells Fargo says. “With lending standards in multifamily tightening and apartment rent growth moderating, we expect the pace of multifamily building to cool in 2017.

December Single Family Starts

|

Region |

Month Change |

December Starts* |

Year to Date* |

|

West |

+6.0% |

193,000 |

+8.0% |

|

Northeast |

+5.1% |

62,000 |

+10.2% |

|

South |

-7.4% |

413,000 |

+8.8% |

|

Midwest |

-9.9% |

127,000 |

+12.8% |

|

U.S. Total |

-4.0% |

795,000 |

+9.3% |

* December starts are seasonally adjusted annual rates. Change in year-to-date starts based on monthly actuals.

December Multifamily* Starts

|

Region |

Month Change |

November Starts* |

Year to Date* |

|

Midwest |

+233.3% |

100,000 |

+28.5% |

|

Northeast |

+78.9% |

34,000 |

-32.7% |

|

West |

+62.4% |

138,000 |

+7.2% |

|

South |

+24.2% |

159,000 |

-2.9% |

|

U.S. Total |

+64.5% |

431,000 |

-3.0% |

* Multifamily starts here include any building that comprise two or more housing units. December starts are seasonally adjusted annual rates. Change in year-to-date starts based on monthly actuals.

The National Association of Home Builders/Wells Fargo Housing Market Index declined 2 points in January to a still-strong 67.

“Although builder sentiment is typically seen as a forward-looking indicator for starts, the 11-year high in December and still-elevated reading in January seems to be somewhat unbridled and could also reflect some election euphoria,” says Wells Fargo. “Similar to residential borrowers, developers likely rushed to lock-in financing. We see the same pattern in consumer sentiment, which is now at a two-year high.

“Looking ahead, the underlying fundamentals and still rising credit availability suggest starts have more room to run. We expect starts to average a 1.17 million unit pace in 2017 and 1.22 million unit rate in 2018.”

![[VIDEO] Caterpillar Plans to Move Global Headquarters to Chicago](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2017/02/default.5891f29812300.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)