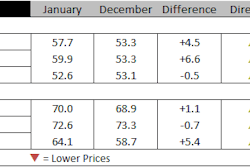

Construction costs rose in April on price strength in materials and equipment, according to IHS Markit and the Procurement Executives Group (PEG). The headline IHS Markit PEG Engineering and Construction Cost Index registered 57.0 in April, the sixth consecutive month of rising prices, and up from the 53.9 reading in March.

The materials/equipment price index came in at 60.1, the first time since February 2013 that this sub-index went above 60. Ten of the 12 categories tracked in the materials sub-index showed rising prices; transformers and electrical equipment registered flat pricing.

Carbon steel pipe had the largest increase in the materials/equipment index this month when compared to March as higher steel input costs and better demand prospects pushed steel pipe prices higher.

“Higher steel input costs and better demand prospects are pushing steel pipe prices higher and will cause prices to escalate further over the next several months. Pipe imports have increased in response to rising demand and they will continue to trend upward and maintain a sizeable share of the market,” said Amanda Eglinton, senior economist at IHS Markit.

The current subcontractor labor index fell in April, coming in marginally below the neutral mark at 49.7. Regionally, U.S. Northeast had rising labor costs, while U.S. Midwest, South and West had flat pricing. Canada pulled the overall index down; in the Western region, prices were flat while in the Eastern regions labor costs fell.

The six-month headline expectations index recorded another month of increasing prices. The index moved up from 67.2 in March to 69.3 this month. The materials/equipment index stayed positive at 72.8, higher than the 70.6 recorded in March. Eight consecutive months of rising prices affirm widespread expectations of future higher costs. Expectations of future price increases were broad-based, with index figures for almost every component coming in well above neutral. Sub-contractor labor price expectations came in at 60.9 in April, higher than the 59.3 recorded in March. Labor costs are expected rise in all regions of the United States. They are expected to remain unchanged in Eastern Canada and to rise in Western Canada.

In the survey comments, respondents have noted shortages for some subcontractor labor categories. Participants continue to express cautious optimism for 2017, with the proposal activity index positive for nine months.