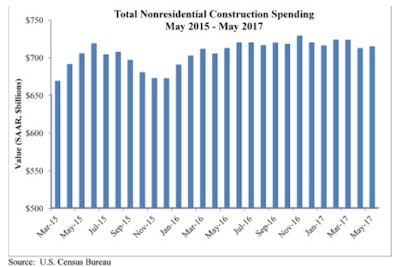

Nonresidential construction spending expanded by 0.3% on both a monthly and yearly basis in May and stands at $714.3 billion on a seasonally adjusted annualized basis, according to an Associated Builders and Contractors (ABC) analysis of a report from the U.S. Census Bureau.

Private nonresidential construction spending fell to $433.6 billion in May, a decline of 0.7%. Private nonresidential construction is now at its 2017 nadir, though it is 0.8% higher than one year ago.

Contrary to the prevailing trend, public nonresidential construction spending rose 1.9% in May on a monthly basis but remains 0.5% lower than in May 2016.

“Interpreting nonresidential construction spending data has become more challenging in recent months,” said ABC Chief Economist Anirban Basu. “Among the sources of perplexity is the fact that the nonresidential construction spending data do not align neatly with trends in other key data. For instance, backlog remains strong and has been rising, according to ABC’s Construction Backlog Indicator and other recent industry surveys,” said Basu.

“Construction employment has also continued to expand, consistent with the notion that the average contractor has been getting busier. Industry stakeholder confidence remains reasonably high, though many industry participants continue to express alarm regarding growing construction skills shortages. But this sense of industry recovery is barely apparent in the nonresidential construction spending data, which indicate that spending has hardly expanded in nominal terms over the past year and is actually down in real terms.

“In prior quarters, it was private segments that drove industry-wide growth, particularly office, communications, lodging, amusement/recreation and commercial segments," said ABC economist Anirban Basu. "In May, it was public spending that led the way, including in the highway and street category, which has generally been a source of enormous disappointment."Associated Builders and Contractors

“In prior quarters, it was private segments that drove industry-wide growth, particularly office, communications, lodging, amusement/recreation and commercial segments," said ABC economist Anirban Basu. "In May, it was public spending that led the way, including in the highway and street category, which has generally been a source of enormous disappointment."Associated Builders and Contractors

“The other apparent inconsistency comes from the shift in construction spending growth from the private sector to the public sector,” said Basu. “In prior quarters, it was private segments that drove industry-wide growth, particularly office, communications, lodging, amusement/recreation and commercial segments. However, there has been some weakening in a handful of private segments recently, despite anecdotal information and survey data indicating elevated real estate developer confidence, low interest rates and busier architects.

“In May, it was public spending that led the way, including in the highway and street category, which has generally been a source of enormous disappointment since the Fixing America’s Surface Transportation Act became law in late 2015. Whether the recent uptick in public construction spending is part of an emerging sustained trend or simply statistical anomaly is not clear. What is clear is that overall nonresidential construction spending growth appears to be stalling, with many prospective purchasers of construction services having apparently adopted a wait-and-see attitude.”