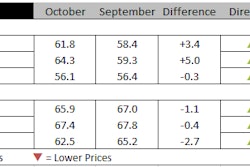

Construction costs rose again in November, according to IHS Markit and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 60.2, supported by strong figures in both the materials/equipment and labor sub-indexes.

The materials/equipment price index was 60.9 in November, moving up from the October figure of 58.9. Price increases were widespread. Every category in the materials index showed higher prices with the exception of ocean freight from Asia to the United States and ocean freight from Europe to the United States; these two categories showed no change in prices. Downstream materials such as transformers continued to post higher index figures, reflective of price increases in raw materials filtering to downstream products. In addition, raw materials such as copper and structural steel continued to post higher index figures relative to last month.

Current subcontractor labor prices rose at a fast pace in November: the index figure came in at 58.5, the highest reading since December 2014. Regionally, costs rose in all four regions of the United States. In Canada, the results were mixed; labor costs fell once again in eastern Canada but they were flat in western Canada.

“Subcontractor rates continued to accelerate over November and expectations for future increases reached a five-year high,” said Emily Crowley, principal economist - pricing and purchasing, IHS Markit. “Tightening labor market conditions combined with an uptick in activity are driving expectations of future rate increases. Currently the U.S. South and West are having the most trouble finding workers leading to stronger wage escalation, whereas the end of major projects in Eastern Canada are keeping pressure off of wages in that region.”

The six-month headline expectations index recorded another month of increasing prices. The index figure moved up from 65.9 in October to 71.3 this month. The materials/equipment index stayed positive at 67.9, a slight uptick from October’s 67.4. Similar to current material/equipment prices, expectations for future price increases were widespread, with index figures for every component coming in strongly above neutral. Price expectations for sub-contractor labor came in at 79.3 in November. Labor costs are expected to rise in all regions of the United States and Canada.

In the survey comments, sentiments remained mixed for the rest of the year and 2018.