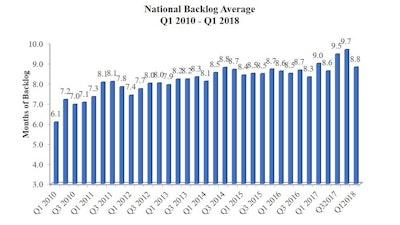

Associated Builders and Contractors (ABC) reports that its Construction Backlog Indicator (CBI) contracted to 8.8 months during the first quarter of 2018, down 9 percent from the prior quarter. CBI is down 2 percent on a year-over-year basis.

“Given improved weather and normal seasonal factors, it is likely that backlog will bounce back during the second quarter. However, the level of improvement may be undermined by a combination of worker shortages and rapidly rising construction materials prices. Despite recent increases in the costs of delivering construction services due to rising human capital and materials costs, there is scant evidence of a decline in demand for construction services,” said Basu.

“The Construction Backlog Indicator hit an all-time high during the fourth quarter of 2017,” said ABC Chief Economist Anirban Basu. “A number of factors pushed backlog lower during the first quarter of 2018, including an extensive winter. Only one region has experienced a decline in backlog on a year-over-year basis: the Middle States, which encompasses the Upper Midwest. There also was a significant uptick in survey participation during the first quarter, which may have helped shape the result. In sum, average backlog remains lofty by historic standards.

Backlog in the West was the only region to grow in Q1 compared to Q4, but most regions saw backlog improvement compared to a year ago.Associated Builders and Contractors

Backlog in the West was the only region to grow in Q1 compared to Q4, but most regions saw backlog improvement compared to a year ago.Associated Builders and Contractors

Highlights by Company Size

Large firms — those with annual revenues in excess of $100 million — experienced a sharp decline in backlog. This overlapped neatly with the decline in backlog related to infrastructure. Backlog for these large firms remains higher than any other classification considered in this release.

Backlog among firms with annual revenues between $50 million and $100 million increased 0.4 months during the first quarter and currently stands at its second highest level since the series began in 2008. This group is heavily impacted by certain construction segments that have experienced little interruption in construction spending momentum.

Firms with between $30 million and $50 million in annual revenues experienced a sharp decline in first quarter backlog. Enhanced survey participation likely explains part of this result. This group is significantly exposed to the energy sector, which stands to see an uptick in activity given recent trends in oil prices.

Backlog for firms with annual revenues of less than $30 million increased 0.3 months during the first quarter and remains remarkable steady. This stability is likely the product of a dearth of available subcontractors to do electrical, mechanical, glass installation and other forms of work.