Commercial property prices continue to climb higher, a fact that does not appear to be dissuading investors. Transaction volumes have recently reversed course and expanded modestly. According to Real Capital Analytics, volumes reached $152.7 billion in the third quarter of 2018, a magnitude not reached since 2015, and the second strongest quarter of the expansion.

Tax reform may be playing a role in the recent pick-up in transaction volumes. Overall, the effects of tax reform should be a net positive for economic growth and be especially beneficial to the CRE industry. For property owners, tax reform will boost revenue growth via stronger economic growth and also draw more capital into the industry, as lower tax rates translate into higher risk-adjusted returns. For example, the new 20% deduction for pass-through entities should make structures a better cash-flow investment and more attractive to investors.

Newly established “opportunity zones” also provide preferential tax treatment to investment in distressed communities. In addition, 1031 like-kind exchanges, which defer capital gains tax on one property when it is exchanged for another, were preserved in the tax bill. The net effect of these provisions will likely be to attract additional capital into the industry, which will bolster property prices and apply downward pressure on cap rates.

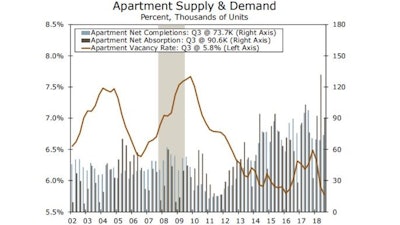

The apartment market is catching a second wind. Continued tight supply of affordable single-family homes combined with rising mortgage rates have caused home affordability to deteriorate, which has dissuaded many renters from purchasing a home. Through the third quarter of 2018, demand for apartments has already eclipsed the demand registered in 2017 in its entirety, and effective rents have risen at the fastest pace since 2016. Moreover, the apartment vacancy rate recently receded to a cycle low.

Industrial properties also continue to be a growth area, as ecommerce inspired supply chain modernization and growing international trade volumes are keeping warehouse and distribution properties in high demand. New development over the past decade has significantly lagged demand and pushed vacancies to all-time lows and led to robust rent gains.

Meanwhile, cautious development has kept the office market in balance. The only markets that have seen significant new supply are the major gateway cities and economies driven by tech and energy, the latter of which was mostly in the first half of the decade. Despite the lack of new supply, asking rent growth has continued to moderate in 2018. Rent growth has been subdued for the past two years, slowing to a sub-3.0% pace.

Demand for hotel rooms continues to be robust, as overall occupancy remains elevated, notably in the upscale and luxury segments. Tax reform has also boosted corporate profits and propelled business travel for company meetings and conventions. Hotel demand tends to track overall GDP growth, which bodes well for the sector’s outlook as we expect the strong economic momentum seen so far this year to extend into 2019.

(more on why the heated CRE market poses little risk to US expansion . . . )