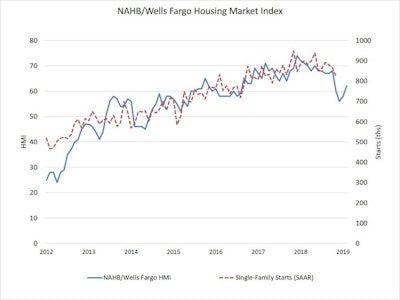

Builder confidence in the market for newly-built single-family homes rose four points to 62 in February, according to the latest National Association of Home Builders(NAHB)/Wells Fargo Housing Market Index (HMI).

The NAHB/Wells Fargo Housing Market Index has seen increases over the first two months of 2019.National Association of Home Builders

The NAHB/Wells Fargo Housing Market Index has seen increases over the first two months of 2019.National Association of Home Builders

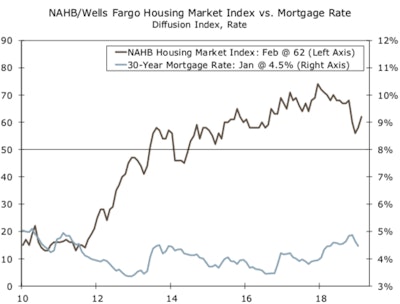

Ongoing reduction in mortgage rates in recent weeks coupled with continued strength in the job market are helping to fuel builder sentiment. In the aftermath of the fall slowdown, many builders are reporting positive expectations for the spring selling season.

February marked the second consecutive month in which all the HMI indices posted gains. The index measuring current sales conditions rose three points to 67, the component gauging expectations in the next six months increased five points to 68, and the metric charting buyer traffic moved up four points to 48.

Wells Fargo Securities

Wells Fargo Securities

Builder confidence levels moved up in tandem with growing consumer confidence and falling interest rates. The five-point jump on the six-month sales expectation for the HMI is due to mortgage interest rates dropping from about 5% in November to 4.4% this week. However, affordability remains a critical issue. Rising costs stemming from excessive regulations, a dearth of buildable lots, a persistent labor shortage and tariffs on lumber and other key building materials continue to make it increasingly difficult to produce housing at affordable price points.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

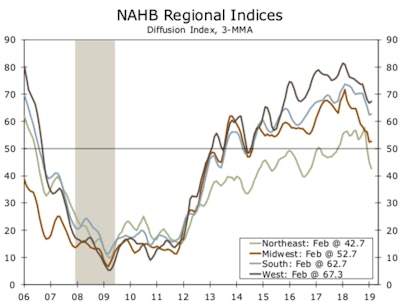

Looking at the three-month moving averages for regional HMI scores, the South posted a one-point gain to 63 while the Northeast dropped two points to 43. The Midwest and West each remained unchanged at 52 and 67, respectively.

Wells Fargo Securities

Wells Fargo Securities