After two consecutive solid years, equipment and software investment growth is likely to slow in 2019 to 4.5% (up from 4.1% in the Economic Outlook published in December), according to the Q2 update to the 2019 Equipment Leasing & Finance U.S. Economic Outlook released by the Equipment Leasing & Finance Foundation. Business and consumer confidence have fallen from the highs experienced last year in the wake of tax reform but remain elevated, and a strong labor market and rising wages should lead to solid consumer spending growth.

Jeffry D. Elliott, foundation chairman and senior managing director of Huntington Equipment Finance, said, “Although the equipment finance industry is off to a slow start this year, business conditions remain generally favorable, and we expect the majority of equipment verticals to post positive investment growth in 2019.”

Highlights from the study include:

- Capital spending exceeded expectations at the close of 2018, despite some weakening in the underlying economic fundamentals. However, business investment faces downside risk in the first half of 2019 given the recent slowdown in the industrial sector and weaker global growth. Credit market conditions remain mostly healthy,

- After achieving 2.9% growth in 2018—tied with 2015 for the strongest year of growth during the current business cycle—the U.S. economy appears to have slowed in early 2019. Consumer spending should continue to serve as the backbone for economic growth, but business investment appears likely to slow after a Q4 rebound due to lower oil prices, easing confidence, and waning global demand. Recent declines in business and consumer confidence and the ongoing negotiations with China on trade policy are two wildcards that should be closely monitored.

- Overall, despite the soft patch in the first quarter, the equipment finance industry should resume its expansionary track in 2019. The industry does face headwinds moving forward, such as contracting investment in residential and nonresidential construction and softening small business sentiment.

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, which is included in the report, tracks 12 equipment and software investment verticals. In addition, the “Momentum Monitor Sector Matrix” provides a customized data visualization of current values of each of the 12 verticals based on recent momentum and historical strength. Momentum readings are above the long-term historical average (y-axis) in 6 of 12 verticals, while 2 of the 12 verticals saw recent momentum (x-axis) accelerate (momentum in 4 verticals was unchanged).

Over the next three to six months:

- Agricultural machinery investment growth is likely to slow

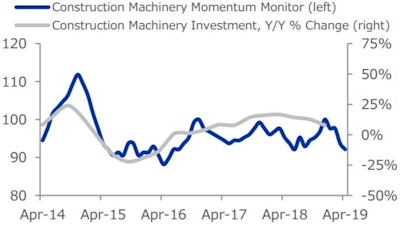

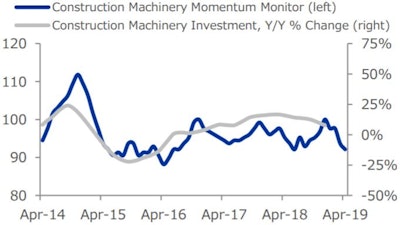

- Construction machinery investment growth should remain weak and may contract (see below)

- Materials handling equipment investment is likely to expand at a modest rate

- All other industrial equipment investment growth will likely remain weak and may stall

- Medical equipment investment growth is expected to slow

- Mining and oilfield machinery investment growth may improve, but a strong rebound appears unlikely

- Aircraft investment should expand at a moderate rate

- Ships and boats investment is likely to remain weak

- Railroad equipment investment growth is likely to remain negative

- Trucks investment is expected to expand at a moderate rate

- Computers investment growth will likely growth modestly

- Software investment growth should slow

'Despite a soft first quarter, equipment financing should resume expansion in 2019. The industry faces headwinds, such as contracting investment in residential and nonresidential construction and softening small business sentiment.' ELFA2019 Equipment Leasing & Finance U.S. Economic Outlook

'Despite a soft first quarter, equipment financing should resume expansion in 2019. The industry faces headwinds, such as contracting investment in residential and nonresidential construction and softening small business sentiment.' ELFA2019 Equipment Leasing & Finance U.S. Economic Outlook

Investment in Construction Machinery contracted at a 0.9% annual rate in Q4 2018 but is up 7.6% year-over-year. The Construction Momentum Index declined from 92.2 (revised) in March to 90.6 in April. In February, Non-Residential Construction Spending edged down 0.5%, while Existing Homes For Sale increased 2.5%. Overall, the Index points to weaker and potentially negative growth in construction machinery investment over the next three to six months

The Foundation produces the Equipment Leasing & Finance U.S. Economic Outlook report in partnership with economic and public policy consulting firm Keybridge Research. The economic forecast provides a three-to-six-month outlook for industry investment with data, including a summary of investment trends in key equipment markets, credit market conditions, the U.S. macroeconomic outlook, and key economic indicators. The Q2 report is the first update to the 2019 Economic Outlook and will be followed by two more quarterly updates before the publication of the 2020 Economic Outlook in December.

Download the full report at https://www.leasefoundation.org/industry-resources/u-s-economic-outlook/.