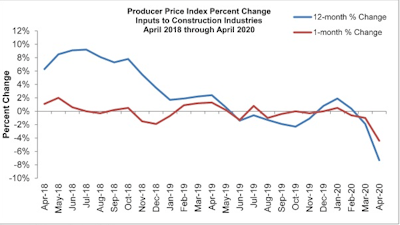

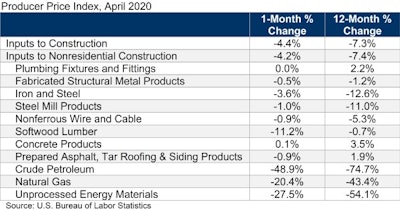

Construction input prices fell 4.4% in April from the previous month, according to an Associated Builders and Contractors (ABC) analysis of U.S. Bureau of Labor Statistics Producer Price Index data. Nonresidential construction input prices declined 4.2% for the month.

Among 11 subcategories, nine experienced monthly price declines. All three energy subcategories considered in this release were lower in April, with crude petroleum down 48.9%, unprocessed energy materials down 27.5% and natural gas down 20.4%.

The only subcategories that didn’t experience monthly price decreases were plumbing fixtures and fittings, which remained virtually unchanged, and concrete products, which increased 0.1%.

Associated Builders and Contractors

Associated Builders and Contractors

“There has been a considerable amount of chatter regarding inflationary pressures recently, given the liquidity injections implemented by the Federal Reserve and trillions of dollars of additional federal spending,” said ABC Chief Economist Anirban Basu. “While inflation may rear its ugly head as the economy recovers from the COVID-19 crisis, for now it is deflationary pressures that dominate. Global demand for energy and many other items has collapsed, placing downward pressure on aggregate price levels.

“For project owners, this may be an important reason to move forward with planned construction projects,” said Basu. “There are cost savings to be reaped during this period as materials prices, including energy prices, falter. Moreover, initiating construction now may position projects to come online as the broader economy begins to recover in earnest.

“The downward pressure on materials prices also makes it more advantageous for the federal government and other levels of government to invest in infrastructure,” said Basu. “Unfortunately, state and local government budgets are being hammered by a paucity of income, sales, hotel and other tax collections. All things being equal, that leaves less money to finance infrastructure projects and makes it less likely that the public sector will take full advantage of presently low borrowing costs. All of this suggests that the federal government should fashion a significant infrastructure-oriented stimulus package in the very near term.”