There are dozens of estimating software programs available for the construction industry. This makes sense because increasing volume of estimating is a key step in growing a construction business. And generating estimates that yield profitable projects versus unprofitable ones is a primary driver of intermediate to long-term success.

Some of these products are desktop software applications, some are affordable mobile device apps aimed at the mom-and-pop-shop and others are increasingly robust enterprise systems bringing highly sophisticated tools that include artificial intelligence (AI) features and market-based pricing data sets. But there are several product trends and strategies that will change the industry.

Estimating Applications Growing “Shoulders”

Estimating is a key process for growing a contracting business, but it is just one process in what should ideally be a connected workflow that starts with the earliest stages of contact with a prospective customer, all the way through to the final application for payment, commissioning or project closeout. And estimating software vendors are now coming to market with functionality for both the earlier and later stages in the process.

Residential estimating app CostCertified, for instance, is not just focused on generating an accurate estimate. They see estimating as central to the sales process and have embedded a multi-user customer relationship management (CRM) tool in the application. Users can create and track leads, assign ownership top leads, track where they came from, and record contact information. There is of course estimating, and tools for use during the project like change orders which after all are really like revised estimates. The software takes that estimate and generates a digital proposal for a prospective owner.

This makes estimating one step in a pre-construction process that begins with the inquiry or lead and then progresses through the project lifecycle.

In March of 2022, CostCertified also announced a partnership with Cedreo, an application that crates 3D home designs for builders and remodelers. While the two companies currently only have one shared customer and a few more in the funnel, with this move CostCertified puts compelling 3D visual home renderings into the estimate and proposal, further linking estimating and the estimate into the sales process.

Subcontracting preconstruction software vendor STACK Construction Technologies actually started life with a "shoulder" earlier in the process from estimating, with its takeoff solution. They then expanded into estimating, becoming perhaps the first unified takeoff and estimating solution in the market. Then in 2021, STACK purchased SmartUse, a tool for viewing and marking up documents in the field. In March of 2022, STACK announced its acquisition of Bid Retriever and K-Ops, setting them on a path to offer a broad construction software suite well beyond its roots in estimating and pre-construction.

Based in Montreal, K-Ops provides a broad operations and project and project portfolio management platform that spans document management, field collaboration, progress tracking and equipment management. The software is used by multiple different types of parties in a construction project, including general contractors, subcontractors, architecture/engineering firms and project owners.

Cleveland-based Bid Retriever is a bid management system that streamlines the bid invitation process, bid submittal and tracking, and would therefore give STACK Construction Technologies functionality upstream of its core takeoff and estimating software.

These moves that eliminate silos between estimating and project delivery should help prevent details, insights and project requirements that often fall between chairs during handoff—a common problem in the industry.

Artificial Intelligence (AI) for Construction Estimating

AI is making its way to market in a number of construction settings, and estimating software is no exception. The challenges faced by a bidding team while responding to a detailed request for information are not, and apologies for the wordplay, to be underestimated. In commercial, civil or major institutional or industrial contracts, when request for proposals comes in, and no two are alike. Estimators must assess the scope of the project from both text-based descriptions and drawings or schematics. Sometimes, winning the project is a greater tragedy than losing if you find later critical details or requirements were missed. This is the problem addressed by an estimating AI tool coming to market soon from Zetane.

An initial phase of the project addressed the problem faced when assessing risk and scope laid out in massive requests for proposals, as the bidding team works to extract the most relevant quantitative data and identify risks that in turn must be quantified and monetized. The goal is to automate the bid generation process with AI and then put insights from this process at the disposal of the project delivery team. A second phase of the project will use AI to identify elements in engineering drawings and schematics and generating an output that can be used in estimating.

The Zetane AI project will target is being designed in conjunction with Pomerleau, which has more than $1.7 billion in revenue. The technology will be geared for and marketed to companies involved in significantly-sized projects. In the meantime, startup Patabid is developing AI estimating tools for the small-to-medium (SMB) contractor. While the company has had a bidding information marketplace, Tenders, on the market for a number of years it in March launched a new product, Quantify, to automate takeoffs using AI.

Patabid’s Tenders product does go substantially up market, and even Pomerleau and other major general contractors are customers. The Quantify product, however, is aimed at smaller contractors, and will start with a strong focus on the needs of building trades, automating takeoffs from general contractors’ RFIs. The net new estimating platform is designed as a solid software-as-a-service (SaaS) alternative to legacy applications from companies like McCormick which is now owned by Foundation and Viewpoint Estimating, Quickpen and Accubid which are now owned by Trimble, Esticon which is now owned by Procore and smaller players like Hard Dollar now rebadged as InEight Estimating.

Over and above this though, Quantify will use AI to count plugs, switches, bulbs and other discrete items that drive the cost of bidding for electrical contractors, and perform similar quantification for other subs, including mechanical contractors. Combined with the existing Tenders project, Patabid will enable contractors to use AI to quantify the bid, identify risks in the project and also determine, based on who else is bidding on which projects and other criteria, whether they should submit for various opportunities. The AI components of the product will be free for the time being until regular use and comments from customers help Patabid refine its performance to the point where it is more reliable.

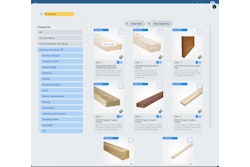

Construction Materials in Estimating Software

Patabid is also laying the groundwork to include in its software and go to market through construction materials supply houses. They will build the supply houses’ pricing into the product and enable contractors to order everything from conduit, connectors, capacitors, motors, temperature controls and even concrete from within the application.

Another new entrant, the Dibbs app, uses the idea of a multi-vendor marketplace for contracting services and materials as the jumping off point for their product, which focuses on residential construction. The app creates a marketplace for both services and materials in the construction industry. Users can use built-in templates to create a post that request services. Once a post is created contractors and materials suppliers can bid on the project from inside the app.