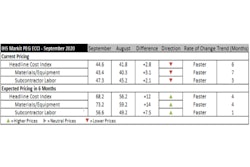

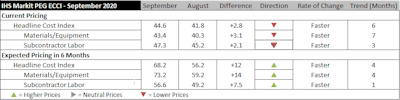

Engineering and Construction costs fell in September, according to IHS Markit and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 44.6 in September. Both the materials and equipment and the subcontractor portions of the index came in below 50, indicating dropping prices.

In the survey comments, respondents continued to note lower demand conditions due to the novel coronavirus (COVID-19) and no shortages for most categories.

The materials and equipment sub-index recorded the seventh consecutive month of falling prices, with survey respondents reporting falling prices for eight out of the 12 components. Ready-mix concrete recorded another month of flat pricing. Ocean freight (from Asia to the U.S. and Europe to the U.S.) prices increased in September after flat pricing in August. Prices for ocean freight dropped in March and April but subsequently registered increases or flat pricing as supply-side cuts drove prices higher. The only other commodity that showed price increases was copper-based wire and cable.

“Copper prices are up by 45% since April and are currently at their highest level since June 2018. The combination of demand in mainland China, disruptions to South American mine production, the loss of the Tuticorin smelter in India and renewed buying by financial institutions provides fundamental support for prices above $6,300 USD per metric ton,” said John Mothersole, director, IHS Markit. “Copper prices will soften across the next two quarters as mine production improves — which it is starting to do. Given the demand outlook outside of mainland China and assuming a better picture of mine supply, we do not see support for prices above $6,500 USD per metric ton during the next six months.”

The sub-index for current subcontractor labor costs came in at 47.3 in September. Labor costs were flat in the U.S. Northeast and rose in the U.S. South. Labor costs fell in the U.S. Midwest and West and in both Eastern and Western Canada.

The six-month headline expectations for future construction costs index was above the neutral mark again in September at 68.2. Both the materials/equipment sub-index and the labor sub-index recorded expectations of future price increases. The six-month materials and equipment expectations index came in at 73.2 this month, up from 59.2 last month, with responders expecting increasing prices for all 12 categories.

Expectations for subcontractor labor registered 56.6 in September, increasing from 49.2 in August. Labor costs are expected to stay flat in both Eastern and Western Canada. For the U.S., labor costs are expected to rise in the South and West and to stay flat in the Northeast and the Midwest.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.