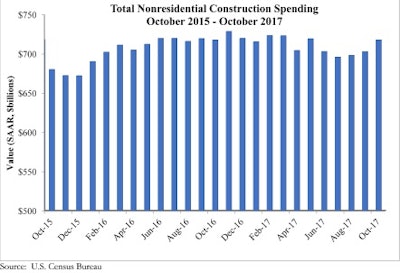

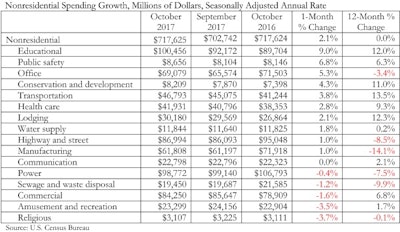

Nonresidential construction spending rose 2.1% in October, totaling $717.6 billion on a seasonally adjusted basis, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data. The level of spending, however, remains virtually unchanged from a year ago.

Ten of the 16 subcategories experienced positive growth, with educational spending topping the list with an increase of 9%. Public safety (up 6.8%), office (up 5.3%) and conservation and development (up 4.3%) were the next highest subcategories. Religious (down 3.7%) and amusement and recreation (down 3.5%) spending saw the largest decreases over the previous month.

“One could scarcely imagine circumstances more consistent with rapid growth in nonresidential construction spending,” said ABC Chief Economist Anirban Basu. “The U.S. economy is humming, coming up on two consecutive quarters of 3% growth on an annualized basis. Consumers, who have been the driving force of the recovery to date, are more confident than they have been in 17 years.

“Stock prices have surged, due in part to liquidity swirling around the growth,” said Basu. “The worldwide economy has not been this healthy for roughly eight decades and global policymakers continue to pursue pro-growth agendas. Interest rates remain extraordinarily low, resulting in greater demand for assets that have the capacity to generate significant income, including commercial real estate. On top of this, there are hopes in corporate America for tax reform, which would presumably accelerate economic growth and bolster corporate profitability.

“In October, nonresidential construction spending rose as one might expect given broader macroeconomic dynamics. There were even signs of life in certain publicly financed categories,” said Basu. “It is likely that construction growth will pick up further next year due to numerous factors, including growing confidence among policymakers in rapidly expanding communities. That confidence should translate into more spending on public works. Of course, whether this logic prevails will depend in part on tax reform legislation outcomes in Congress.”