This list has fluctuated significantly year to year, partly because it’s gone from 75 companies to 50 to 75 and then this year back again to 50. But as the figures below hint, there’s got to be more to the fluctuation than the size of the list.

Start with this year’s Pavement Repair-only sales, which totaled $165,080,441 for 50 contractors. Now consider this:

2016 – $255 million in sales, list size 75 companies

2015 – $269 million in sales, list size 50 companies

2014 – $141 million in sales, list size 75 companies

So the largest total of pavement repair-only sales was in 2015, when the list contained 50 companies – the same size list as this year when repair-only sales barely topped $165 million (second-lowest total in the four years we’ve tracked this).

But 2015 seems to have been a high-water year for most industry segments as the pent-up demand for paving and pavement maintenance work resulted in a flood of work and revenue for contractors. It’s also a certainty that adding 25 contractors to the list would have brought us closer to the 2016 sales dollars if not the 2015 figures.

But regardless of where the totals are this year, and while few contractors would label themselves “pavement repair contractors,” pavement repair-only sales surpass striping-only and sealcoating-only sales. This clearly emphasizes the importance of this category not only to clients but to contractors as a revenue generator.

Total sales for all the work the 2017 Pavement Repair 50 was $813,442,954, down from $1.28 billion last year, which was down $500 million from 2015 when only 50 companies reported $1.779 billion in sales (which was up more than $700 million over 2014’s sales of $1.044 billion when the list had 75 contractors).

Pavement repair-only sales account for 20% of total list sales – the same as in 2016. Average pavement repair-only sales for 2017 was $3,301,608 – very close to the average repair-only sales last year of $3,356,169 (down from $5.3 million in 2015, which was way up from $1.88 million in 2014).

With pavement repair-only sales accounting for only 20% of list sales, it’s clear that this work goes hand-in-hand with other pavement maintenance work. Contractors in the Pavement Repair 50 perform other work as follows:

· 47 contractors perform paving work (94%)

· 48 contractors perform sealcoating work (96%)

· 47 contractors perform striping work (94%) though striping is a much less significant aspect of the business

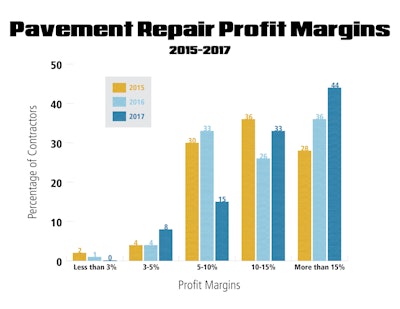

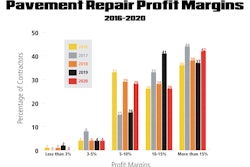

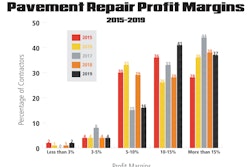

Profit Margins Grow

For this year’s Pavement repair 50, profit margins are sound – and continue to improve: 44% reported margins greater than 15% (up from 36% last year, 28% in 2015 and from 34% in 2014); 33% reported margins between 10-15% (up from 26% last year but down slightly from 36% in 2015 and 2014). That means that 77% of the Pavement Repair 50 generated more than 10% profit from their work (vs. 62% last year, 64% in 2015 and 60% in 2014). Another 15% reported margins between 5-10% (down sharply from 33% last year, 30% in 2015 and 25% in 2014), and 8% earned margins of 3-5%, up from 4% last year. No contractors reported earning less than 3% margin.

Where the Pavement Repair 50 Work

As with the Sealcoating 50, work for contractors in the Pavement Repair list is focused off-road, with 12% reporting 100% of sales from parking lots, 26% reporting 90% or more of sales from parking lots, and 64% reporting sales from driveway work. All of the Pavement Repair 50 indicated they generate sales from parking lot work. Still, 56% report sales from work on streets and 16% report they work on highways.

The Pavement Repair 50’s Customers

· 49 contractors work for commercial/industrial customers (98%)

· 45 contractors work for multi-family residential customers (90%)

· 35 contractors work for municipal clients (70%)

· 23 contractors work for single-family homeowners (46%)

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)