The 2018 Paving 75 contractors generated $633,745,590 in paving-only sales, down from almost $713 million in 2016 and from $875 million in 2015, but up from and $621 million in 2014 -- the last three years the list included 75 companies. (The 2017 list generated a bit more than $503 million in paving-only sales from 50 companies.)

The step-back to slightly above 2014 levels could represent a more accurate level for this group. As we’ve speculated in the past, paving-only sales in 2016 and 2015 almost certainly spiked as a result of pent-up demand from the Great Recession. It’s likely that delayed work has now been completed and customers are settling into a more “normal” level of reconstruction and overlays.

Not surprisingly, paving-only sales continue to dwarf sales of other industry segments, with pavement repair-only sales coming in second at $265 million, followed by sealcoating-only sales at $171 million and striping-only sales at $143 million.

Total Sales for Paving 75

Total sales for all the work the 2018 Paving 75 did was $1,342,851,729 – surpassing 2014’s $1.122 billion yet staying below $1.649 billion in 2015 and $1,548 billion in 2016. (The 2017 Paving 50 reported $962,411,076 – the lowest total since we began reporting this information in 2014.)

So the 2018 paving-only sales represent 47% of total list sales, up from 46% in 2016, down from 53% in 2015 and from 55% in 2014. The remaining 53% of sales come from a broad mix of other pavement maintenance services:

- 69 companies perform sealcoating work (92%)

- 56 companies perform striping (75%, though 40 of those companies generate 5% or less of sales from striping)

64 companies perform pavement repair work (85%)

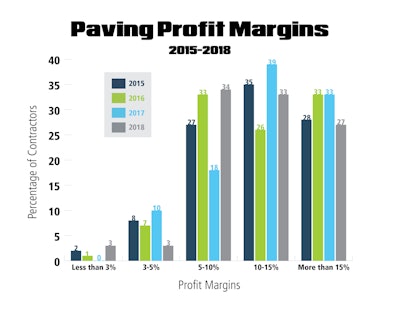

Profit Margins Decline

As the chart on this page shows, contractor profit margins within the Paving 75 shifted noticeably lower. The percentage of Paving 75 contractors reporting margins of greater than 15% declined to 27% from 33% in both 2016 and 33% in 2017.

Margins in the 10-15% range remained static at 33%, but margins in the 5-10% range jumped dramatically to 34% from 18% last year and slightly above the 33% reported in 2016.

So contractors reporting margins of greater than 10% was 60% – compared to 55% in 2013, 54% in 2014, 63% in 2015 and 59% in 2016. (Last year with 50 companies 72% reported margins greater than 10%).

Only 6% of the Paving 75 reported generating less than 5% profit margin.

Where Pavers Work

There’s no question that the Paving 75 emphasize off-road work, with 11% reporting 100% of sales from parking lots, 22% reporting 90% or more of sales from parking lots, and 56% reporting sales from driveway paving.All of the Paving 75 indicated they generate sales from parking lot work. Still, 69% report sales from work on streets and 19% report they work on highways.

The Paving 50’s Customers

- 72 contractors work for commercial/industrial customers (96%)

- 64 contractors work for multi-family residential customers (85%)

- 50 contractors work for municipal clients (66%)

- 41 contractors work for single-family homeowners (55%)

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)