For two years’ running we’ve made the case that the Striping Top Contractor list shows the steadiest growth and the most stability.

Make that three years’ running.

Total striping-only sales for the 2018 Striping 75 was $143,689,274 -- the highest striping-only sales since we started tracking in 2013. Interestingly, last year, when we cut the list to 50 companies, the 2017 Striping 50 totaled just over $139 million in striping-only sales, which was up from just over $133 million in 2016, $112 million in 2015 and $92 million in 2014. Pretty steady growth among the striping-only segment of the industry.

As additional evidence, consider the total sales for all work done by the contractors making up the Striping 75:

- $1,248,227,373 for 2018

- $926 million in 2017 (50 companies)

- $1.177 billion in 2016

- $1.5 billion 2015

- $1 billion in 2014

Why so stable? It’s possible that the striping industry was not hit as hard by the Great Recession – so it didn’t experience the decline felt by the other industry segments – nor did it experience the sharp resurgence of those segments because there was little pent-up demand. As a result the industry did not see the huge leaps in sales that, for example, the paving and sealcoating segments displayed.

2018 striping-only sales represent 12% of total list sales, up from 11% last year, 7% in 2015 and from 9% in 2014 (down from 15% last year with 50 companies).Average striping-only sales was $1.906 million – up from $1.774 million in 2016, from $1.492 million in 2015 and from $1.297 million in 2014.Other revenue was generated as follows:

- 56 companies pave (75%)

- 67 companies sealcoat (89%)

63 companies repair pavement (84%)

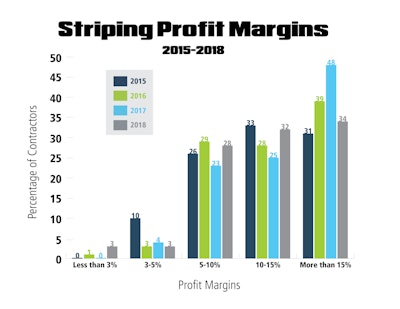

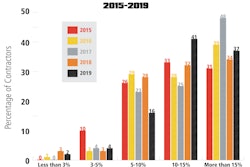

Profit Margin Shift

As we’ve seen this year with other Top Contractor lists, profit margins for the Striping 75 have shifted from the highest end to the middle ranges.

Those reporting margins greater than 15% declined to 34% from 48% last year (50 companies), and from 39% in 2016. But those highest-end numbers are up from 31% in 2015,and from 30% in 2014. Companies earning 10-15% profit rose to 32% this year (from 25% in 2017 and from 28% in 2016). The percentage of contractors earning more than 10% profit was 66%, down from 73% in 2017 and from 67% in 2016 but up from 64% in 2015.The percentage of contractors earning 5% or less rose slightly to 6%, up from 4% last year but a significant improvement over the 10% figure reported in 2015.

Where Stripers Work

All Striping 75 companies generate sales from parking lot work, with 9 companies reporting 100% of sales from parking lots and another 20 companies reporting 90% or more from parking lots. Work on roads and streets generates sales for 52 companies; 16 companies indicated they work on highways.The Striping 75’s Customers

- 74 contractors work for commercial/industrial customers (98%)

- 62 contractors work for multi-family residential customers (83%)

- 44 contractors work for municipal clients (59%)

- 36 contractors work for single-family homeowners (48%)

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)