Sealcoating-only sales for the 2019 Sealcoating 50 totaled $137,350,355 – a significant increase over the more than $112 million total of the 2017 list, the last time the list had 50 companies.

Just for historical purposes (and not for direct comparison), the sealcoating-only sales totals for the last few years when the list included 75 companies was $171 million in 2018, $201 million in 2016, and $249 million in 2015. We have consistently noted that the high-volume years of 2015 and 2016 likely are the result of pent-up demand and that sealcoating-only totals are settling into a more “normal” level since then.

Sealcoating-only sales trailed all other industry segments (as it has each year of the survey), with paving-only sales surpassing $493 million, striping-only sales reaching $215 million, pavement repair-only sales at $209 million, followed by sealcoating-only sales at $137 million.

Sealcoating-only sales represent 14% of total Sealcoating 50, up slightly from 13% in 2017 (50 companies), the same percentage of last year’s list and down from 15% in 2016. The remaining sales represent a broad mix of pavement maintenance-related work, including:

- 42 companies perform paving work (84%)

- 46 companies perform striping work (92%)

- 42 companies perform pavement repair work (84%)

The sealcoating list results certainly reinforce the diversity within the industry – in fact, none of the 50 companies on the list performs only sealcoating (one generates 98% of sales from sealcoating) and only two of the companies generate 75% or more of sales from sealcoating.

Total sales for all the work the 2019 Sealcoating 50 did was $977,868,368 – again a significant increase over the more than $885 million total sales reported of the 50-company list in 2017. (For the years the list included 75 companies, total sales were $1.249 billion in 2018, $1.299 billion in 2016, and $1.531 billion in 2015.)

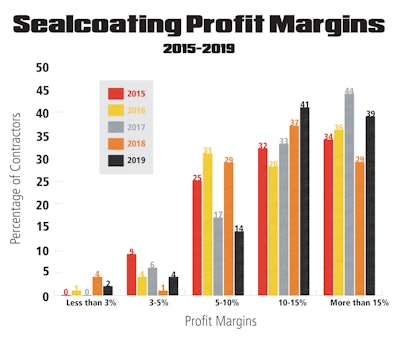

Profit Margins

Despite the fact the sealcoating-only sales volume brings up the rear of the four industry segments, that doesn’t mean sealcoating has to be less profitable than the other segments.

This year 2% of contractors on the list report margins of less than 3%; 4% report margins between 3-5%; 14% report margins of 5-10%; 41% report margins of 10-15%; and 39% report margins of greater than 15%. As the chart on this page shows, the big shift is from the middle 5-10% range to the higher-margin ranges. The good news is that 80% of the Sealcoating 50 reported margins of 10% or more (consistent with the 77% in 2017). This reinforces the theory that the companies with larger sales volumes are able to translate that into larger margins.

Where Sealcoaters Work

Consistent with other years and with the sealcoating service, contractors on the Sealcoating 50 emphasize off-road work, with all but one of the Sealcoating 50 indicating they generate sales from parking lot work. Six percent report they generate 100% of sales from parking lots, another 26% report 90% or more of sales from parking lots, and 67% report sales from sealcoating driveways; 62% report they work on streets; 14% report they work on highways.

The Sealcoating 75’s Customers

- · 49 contractors work for commercial/industrial customers (98%)

- · 36 contractors work for multi-family residential customers (72%)

- · 38 contractors work for municipal clients (76%)

- · 26 contractors work for single-family homeowners (52%)

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)