This is becoming repetitive. Once again, the Striping Top Contractor list shows the steadiest growth and the most stability of the four lists. That’s because for the fourth year in a row the total striping-only sales has not only climbed but climbed substantially – and it doesn’t seem to matter whether the list is made up of 75 or 50 contractors.

Striping-only sales for the 2019 Striping 50 totaled $215,294,955 – way up from last year’s $143,689,274 when the list contained 75 companies (at that point the highest striping-only sales total since we started tracking in 2013). In 2017 when the list included 50 companies, striping-only sales totaled just over $139 million, which was up from just over $133 million in 2016, $112 million in 2015 and $92 million in 2014.

We’d say that’s a trend.

Despite the significant increase in striping-only sales, total sales for all work done by the contractors making up the 2019 Striping 50 declined to $1,070,921,735 from $1.248 billion last year, (75 companies) but was an 8.6% increase over 2017 when the Striping 50 reported $926 million in total sales. Total sales for recent years when the list included 75 companies was:

- $1.177 billion in 2016

- $1.5 billion 2015

- $1 billion in 2014

It’s probably safe to say that striping-only sales rose substantially because larger, striping-focused contractors participated in this year’s survey. And that’s been the trend. Reinforcing that is the fact that in 2019 striping-only sales represented 20% of total sales for the Striping 50, up from 15% in 2017 (50 companies) and 12% in 2018, 11% in 2016, 7% in 2015 and 9% in 2014. Other revenue was generated as follows:

- 32 companies pave (64% vs. 72% in 2017 and 75% in 2018)

- 42 companies sealcoat (84% vs. 88% in 2017 and 89% in 2018)

- 34 companies repair pavement (68% vs. 78% in 2017 and 84% in 2018)

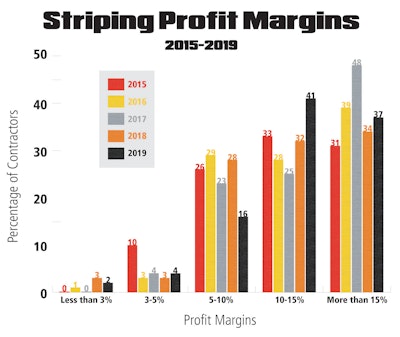

Profit Margin Shift

Profit margins for the Striping 50 shifted dramatically toward the high end, and the shift came at the expense of the middle margin range. Only 16% of the Striping 50 reported margins in the 5-10% range – down from 28% last year and from 23% in 2017. But contractors reporting margins in the 10-15% range rose to 41% (from 32% in 2018 and 25% in 2017). Those reporting the greatest margins, more than 15%, rose to 37% (from 34% in 2018 but down from 48% in 2017). The percentage of contractors earning 5% remained stable from last year at 6%, which was up from 4% in 2017 but considerably less than the 10% figure reported in 2015.

Where Stripers Work

All but one Striping 50 company generates sales from parking lot work, with 5 companies reporting 100% of sales from parking lots and another 12 companies reporting 90% or more from parking lots. Work on roads and streets generates sales for 35 companies; 11 companies indicated they work on highways.

The Striping 75’s Customers

- 49 contractors work for commercial/industrial customers (98%)

- 36 contractors work for multi-family residential customers (72%)

- 39 contractors work for municipal clients (78%)

- 34 contractors work for single-family homeowners (68%)

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)