Here is the history of Pavement Repair-only sales:

2020 – $217,721,018 (list size 50 companies)

2019 – $209 million (50)

2018 – $265 million (75)

2017 – $165 million in sales (50)

2016 – $255 million in sales (75)

2015 – $269 million in sales (50)

2014 – $141 million in sales (75)

The 2020 repair-only sales total represents the second-highest total for a year when we listed 50 companies, coming in far behind 2015 (which was a post-Great Recession year when pent-up demand was resulting in unusually large sales numbers).

Total Sales for the Pavement Repair 50

Total sales for all the work the Pavement Repair 50 did was $1,360,280,901 – way up from almost $981 million last year and $813 million in 2017.

As a percentage of total sales by the Pavement Repair 50, pavement repair-only sales accounted for the smallest percentage ̶ 17% ̶ since we started tracking this industry segment in 2014. That’s down from 21% last year and from 20% in 2017.

While it’s difficult to explain the decline, we’ve always noted that many contractors lump pavement repair in with their paving work. It’s possible that large contractors are even more likely to do this as patching and small repairs are often part of large overlay jobs – and with large contractors joining the lists this year that could account for the difference from previous years.

Contractors in the Pavement Repair 50 perform other work as follows:

- 35 contractors perform striping work

- 44 perform paving work

- 46 perform sealcoating work

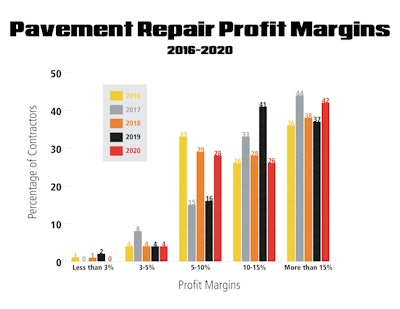

Profit Margins Trend Higher

Profit margins for the 2020 Pavement Repair 50 followed the trends of the other segments this year, tilting to higher margins while the middle margins experienced a shift.

- 42% reported margins of more than 15%, up from 37% last year and near the high of 44% in 2017

- 26% reported margins in the 10-15% range, down from 41% last year and from 33% in 2017

- 28% reported margins in the middle 5-10% range, up from 16% last year and from 15% in 2017

- 4% reported margins of 5% or less, down from 6% last year

- No contractors reported margins less than 3%

So 68% of the Pavement Repair 50 generated more than 10% profit for their work (compared to 78% last year and 77% in 2017).

Where the Pavement Repair 50 Work

All but one of the Pavement Repair 50 indicated they generate sales from parking lot work, with six companies (12%) generating 100% of their sales from parking lots and another 12 (24%) reporting 90% or more of sales from parking lots.

Possibly demonstrating the impact large paving companies are having on the list, roads and highways make up a decent percentage as well with seven companies (14%) reporting sales from highway work (the same as last year) and 37 companies (74%) report sales from streets and roads (up from 20 companies last year).

The Pavement Repair 50s’ Customers

- 49 contractors work for commercial/industrial customers

- 47 contractors work for multi-family residential customers

- 39 contractors work for municipal clients

- 22 contractors work for single-family homeowners

Replacing the Pavement Repair 50s’ Equipment

Only one company reported it would cost less than $500,000 to replace their equipment. Another 11 reported it would cost $500,000-$1 million to replace their fleet; nine companies said it would cost $1-$2 million; and 29 companies reported it would cost more than $2 million to replace their equipment.

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)