By Greg Waldorf, CEO of Invoice2go

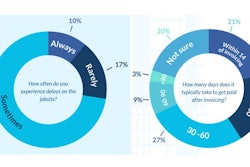

The first rule you learn in business is, to be successful, you need to have more money coming in than money going out. That might seem simple, but it’s a lot easier said than done: 82% of businesses fail because of cash flow problems. Without money coming in from completed work, you can’t pay for materials, your employees’ salaries, and other necessary business expenses. It’s a crippling problem that every construction business owner needs to be aware of and actively avoid.

Cash flow can be a problem for many industries, but those in construction and other invoice-dependent industries are especially affected. The estimating, bidding, and winning of projects is a time-consuming process that takes a lot of staff hours and resources. So there’s nothing worse than doing all that work upfront to secure a job, investing time and money in the project, and then, in the middle of the project, hitting a roadblock by running low on cash. At that point, it’s too late to ask a customer for the money needed to complete the job, so contractors and managers are left scrambling to find another way to come up with the capital. Sometimes that means using cash from the business’s reserves, or taking out a loan. Both of those options carry unnecessary risks and should be avoided whenever possible.

The good news is there is a way to avoid this situation by implementing a deposit requirement. By asking for a deposit before the work begins, construction managers can set the stage for a successful project from the start. Most clients will have no problem with paying a deposit and may even prefer splitting the cost across a longer period of time rather than paying the entire invoice at once.

Once you decide to implement a deposit requirement, you'll then need to decide how large of a deposit is required. An appropriate deposit varies according to the project, industry, timeline, and client. For example, if you’ve worked with a client for years and they have always paid their bills on time but prefer to split the cost between several payments, you should take that preference into consideration. Or if the project has a lengthy timeline, it makes sense to divide the cost into more installments than you would for a shorter project. A general rule of thumb to consider is the deposit should be proportional to the overall cost of the project – the bigger a project is, the larger the deposit should be.

These considerations will help you set up a system that works for you and your company. What you may not realize about deposits, though, is that in addition to the benefit of formalizing the commitment, they also improve overall cash flow by helping seal the deal for more jobs, automate payments, cover out-of-pocket expenses, and save time throughout the life of the project. Here’s how they provide value:

- Help seal the deal on projects.

Deposits are important because managers don’t have the stress of a client backing out mid-project and the client gets to split the payments while maintaining their leverage of the remaining invoice amount. For that reason, potential clients will likely see the deposit as a positive thing, and it may help sway them to go with your company versus a competitor. Our research shows that businesses using our deposit feature are closing, on average, 11% more jobs than those who do not. That can make a big difference, especially for small businesses or companies struggling during an economic downturn.

- Automate the payments coming in.

Simplifying and improving your estimating and invoicing process, while adding a deposit requirement, will automate the money coming in so that your team isn’t constantly having to chase down payments at the completion of a project.

If you haven’t already, you can start by creating a set, organized, and automated process that everyone in your company understands and follows. This can be made easier with invoicing software that automates steps of the process, which is vital in boosting cash flow and will be your first line of defense for dealing with cash flow problems. When you bid on a project, follow the process you’ve set up and send an itemized estimate to the client that outlines each action item and the cost associated with it. Having that information listed out helps your process because it forces you to think through the steps you’ll have to take for the project and the realistic costs that come with each action item. It will also give your client peace of mind about the expense to see exactly what the project entails and what each part is going to cost. In every one of your estimates, language about the deposit requirement should be included so that your clients are aware from the beginning.

- Cover out-of-pocket expenses.

While the actual amount of your deposit requirement will vary from client to client, it’s important to make sure the amount will cover your out-of-pocket expenses, so you don’t get stuck mid-project without the capital to move forward. It may not seem like a big deal to dip into your business’s own savings, but that puts the financial strain solely on your business and is a bad habit to get into.

A great example of why it’s important for the deposit to be proportional to the overall project cost is an experience a client of ours had. He landed a $25,000 project but only collected his standard $500 deposit. That $500 covered the first five days of the project, and he spent the next three weeks scrambling to find the cash he needed to complete this project. He’s since changed his policy and now asks for 25% of his project fee upfront and 25% halfway through. He hasn’t had to dip into his personal savings since he implemented that change, and as an added benefit, his customers are more comfortable paying their invoices because they’re paying smaller installments.

- Save time throughout the project.

As soon as your customers receive their estimates, they can immediately make their deposit payments. You’ll receive their deposits more quickly and you won’t waste time reconciling payments. By receiving funds upfront, your team can get up and running faster, saving them time over the life of the project. You can also take additional steps like sending reminders throughout the process rather than waiting until the project is completed, which will save staff hours. To further incentivize your clients to pay on time, you can implement specific payment terms like a one-time late fee or even a percentage increase for each week the invoice isn’t paid.

Having an organized, automated system for estimating and invoicing is an essential part of any construction business’s success, and deposit requirements are an easy way to strengthen that system further. By acquiring capital upfront, you will set your team up for success for the entirety of the project and create better financial habits for your company. Incorporate deposit requirements and see how it changes your company’s cash flow for the better.

Greg Waldorf is the CEO of invoicing and