Teletrac Navman, a global software-as-a-service provider that leverages location-based technology for GPS tracking solutions, announced findings from its Telematics Benchmark Report: Global Construction Edition. The survey found that with 42% of organizations experiencing a talent shortage, more are taking action to address it, including increasing pay (50%), offering better benefits (35%) and providing flexible work arrangements (29%).

The survey also found companies are seeing benefits from GPS tracking and investing in their fleets. Key insights from the survey include:

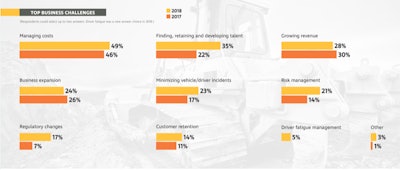

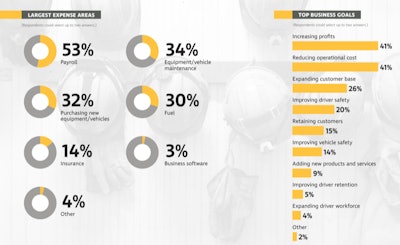

Organizations’ top business challenges and goals reflect their largest expenses

- 49% said managing costs was their top business challenge, while 41% named increasing profits and reducing operational costs as their top goals.

- 35% said retaining and developing talent was their top challenge, with payroll as their biggest expense (53%).

- Equipment/vehicle maintenance (34%), purchasing new equipment/vehicles (32%) and fuel (30%) were companies’ other largest expenses.

GPS tracking and big data analytics use on the rise as fleets see cost and safety benefits

- 85% of organizations either currently use GPS fleet tracking or plan to in the next year, citing equipment tracking as the most common use (76%), followed by speed (62%) and driver hours (58%).

- 55% have seen lower fuel costs since implementing telematics, with 21% trimming costs by 11% or more.

- Top safety benefits realized by using GPS tracking include speeding prevention (37%) and improved driver behavior (34%).

- 21% say they’re applying big data analytics to business operations, up 12% from 2017.

- 37% expect big data analytics to be the technology that will most greatly impact business in the future, over autonomous vehicles (24%) and smart cities (12%).

Organizations are investing in their employees and equipment, reflecting positive industry outlook

- 42% are investing in finding, retaining and developing talent.

- More than 50% of organizations experienced equipment failure in 2018, prompting 72% to invest in new vehicles.

- Driver warning/alerting technology (24%) and drones (12%) are the top two emerging technologies being considered for implementation this year.

“Despite the hype around autonomous vehicles and artificial intelligence, our survey found fewer than half of organizations are investing in emerging technologies this year,” said Mika Majapuro, Director, Project Management & Strategy, Teletrac Navman. “When they do invest in it, they seek more practical, safety-oriented solutions like driver alerting technology that will improve operations immediately rather than long-term, ‘futuristic’ technology. In this case, the technology they’re investing in per the report is also a powerful talent retention tool, as operators want to work for companies that invest in their well-being.”

Survey methodology

The 2018 Teletrac Navman Benchmark Survey includes responses from more than 2,400 fleet operations and fleet management professionals from around the world. Of the total survey respondents, 646 indicated their primary industry was construction, mining or oil or gas. The results described in the report were compiled from those respondents. This report provides an understanding of best practices and fleet management trends in business, general telematics, emerging technology, transportation, external factors and talent. Results may not amount to 100 percent due to questions with multiple selections. For reporting purposes, all statistical values have been rounded to the nearest whole number.