While you may have done nothing wrong, you still need to seek forgiveness or pay the price. At least, that’s the case if you borrowed money from the Small Business Administration (SBA) and participated in the 24-week Paycheck Protection Program (PPP) designed to provide funding to keep workers employed.

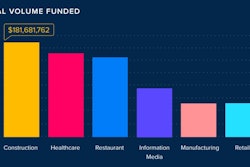

It appears that contractors as a group were one of the largest industry segments to receive funds — $64 billion at last count. Consequently, you can expect SBA oversight to be somewhat more intensive with this group.

Hopefully, you complied with all the PPP rules when applying for the loan by actually spending time to understand what the funds could be used for. What excited most business owners is the expectation of not having to repay the loan if regulations were followed. Even if you do not qualify for 100% forgiveness, the outstanding balance becomes a 5-year loan at 1% interest.

It appears the forgiveness side of the equation is more complicated than the funding segment. The borrower needs to match any qualified expenses to the amounts used in the loan application following the forgiveness regulations.

Importance of Payroll Data

Hopefully, you used a payroll service that can provide the payroll data needed to measure your actual 24-week qualified payroll amount against the loan request. This can get a little complicated, especially in your business, and may take some homework to get it right. Get it wrong and you may wind up with a 5-year loan you did not expect to incur.

The most important part of the forgiveness program deals with payroll because the funding is primarily geared to keeping people employed. To that end, loan forgiveness will be reduced if you lowered wages by more than 25% or failed to maintain the number of full-time equivalent (FTE) employees during the period as compared to the previous period used in the loan application. Given what is happening in the market, I know of many instances where lowering pay or laying off personnel is a must even though you applied for funding.

There are, however, exceptions to the rules:

- If the contractor can prove government or public agency mandates prevented full operations — e.g., a region is shut down or jobs are put on hold related to COVID-19

- If the contractor tried to rehire a furloughed employee in good faith but the employee declined

- If a contractor tried to fill an open position but was unable to by December 21, 2020

- If the employee voluntarily resigned or was fired for cause

The payroll service can run payroll data to determine if you fall into any of these pitfalls, and in many cases, can help you understand what the reports say and why they turned out the way they did.

Can You Prove You Needed the Money?

As part of PPP applications, the borrower needed to certify that ongoing economic uncertainty made the loan a necessity to continue operations. You may need to demonstrate that fact. In other words, did you really not have access to capital and need the PPP funds?

What makes this question interesting is the fact that contractors may have needed to conserve cash or build reserves for committed obligations like pension funds or a job scheduled to start in the future. Be prepared to address these issues.

However, if you borrowed $50,000 (subject to affiliated group rules) or less, this is your lucky day because a new interim SBA rule says you are exempt from any reductions in forgiveness based on reductions in FTE employees and in employee salaries or wages. But for the rest of you, the rules previously stated apply.

At a minimum, construction companies should be prepared to produce:

- payroll processing records

- payroll tax filings

- Form 1099 for self-employed construction owners

- bank records

- utility, mortgage and/or rent statements

- lease agreements

- PPP application forms and supporting documents

Finally, the loan proceeds are not taxable. However, expenses that normally would be a deductible expense and have been forgiven are not deductible. So, there could be a difference between what is forgiven and what is no longer deductible.

PPP forgiveness helps you, your company and your employees. If you find yourself behind the ball regarding this process, ask your accountant or banker for help.