The market for mobile power can involve from neck-breaking swings of the pendulum, depending on numerous economic factors. Today, the adoption of Tier 4 engines and anxiety over the oil and gas market are main factors in the demand for generators. To get a feel for what’s happening, we asked several industry stakeholders what they’re seeing. Following is an excerpt from that discussion

Rental: How would you characterize the current market for mobile power?

Emily Kocik, marketing & strategy manager - global rental segment, Cummins Power Generation: The rental market has seen consistent growth, especially for temporary power. We’ve seen an increase in business over the last 3-5 years in North America and in other parts of the world across our entire product range, especially for containerized sets. [End-users] are looking for rental power suppliers who can respond quickly and provide equipment that is fuel efficient, highly reliable and meets all current environmental requirements.

Todd Howe, product marketing manager - generators, Doosan Portable Power: Business is good, utilization is high, there are definitely good conditions out there. It’s not necessarily lining up with investment or expansion in fleet, but that’s got more to do with things like Tier 4 as opposed to the general health of the construction industry and other markets the rental industry serves. I see things going in a positive direction but at a much slower pace than last year. Rental companies are trying to get rental rates on Tier 4 products to come up so they can get good ROI on a much more expensive asset, that’s really the challenge we’re facing. Considering the headwinds with getting Tier 4 adoption in the marketplace... at the fleet buyer level but also all the rental companies trying to get rental rates to come up so they can get good ROI on a much more expensive asset, that’s really the challenge we’re facing. The fact that the market hasn’t just fallen off the cliff is a good indication, but I think it’s going to take us another couple of years to get Tier 4 acceptance fully ingrained in the end user from both an understanding of what the costs are as well as the operating implications when using a product that’s got a Tier 4 engine in it.

Terry Dolan, executive vice president, Generac Mobile Products: There are challenges in the mobile power market, but it is growing. We are cautiously optimistic about the prospects for the year. The general health of the economy will drive the need for mobile power equipment. There is a definite need for mobile power in the marketplace, and it continues to adapt to new Tier 4 products. The current demand for higher-tier diesel products is a bit soft, though. Customers prefer Tier 3 flex generators, as these models are less expensive and don’t require additional emission management items. Natural gas units that run on well gas continue to be in high demand. They help reduce fuel costs and emissions, making them an excellent choice for production.

The recent drop in oil prices has impacted oil and gas production, which has put higher visibility on the need to drive production costs down on well sites. The emergence of gaseous generators that run off of well gas provides great cost savings compared with diesel generators. The adaption of this innovative product has been increasing over the past year. We also are experiencing increased activity in other industries, such as construction and hospitality.

The fluctuating oil and gas prices, harsh Northeast winter and engine tier transition have resulted in lower demand in 2015 compared with 2014. We do expect demand to increase as we see stabilization in the market. An uptick in the housing market will combine with increased use of mobile power during summer construction to drive demand.

Tony Crandall, Buckeye Power Sales, Columbus, OH: Here in the Midwest we’re starting to see a resurgence in industrial work as last year industrial work decreased significantly. Now we are also starting to get a lot of requests for medium- to large-scale event work, which is a welcome expansion for us.

Anne Feudner, product manager, Kohler Co.: This year, were projecting a pretty strong double-digit growth. By 2019, were expecting things to slow down to just north of GDP.

Rental: How much of a factor is the oil and gas segment in the current demand for mobile power?

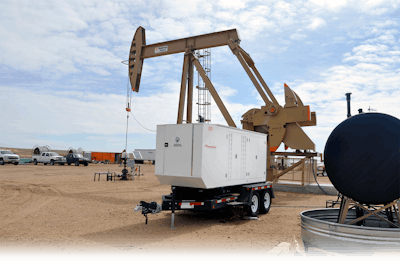

Dolan: The oil and gas segment is a major factor in the demand for mobile power. Demand has been very strong in past years, but recently, lower oil prices have reduced rates and utilization of mobile power in the oil and gas segment. This has resulted in a lower demand for new products and a reallocation of existing units from the oil and gas market to markets with stronger demand, such as construction.

There are big opportunities for gaseous generators because of their improved economics and the desire of end users to reduce their consumable fuel costs. This is a significant factor in the demand for mobile power, and we believe it will continue to be one in the long term.

Feudner: Oil and gas exploration is slowing, but is more than offset by the rent vs. buy value proposition. From a manufacturer’s perspective, we believe the market is still growing based on rental vs. buy economics and strong growth in nonresidential construction. We have a broader base of customers, so we can ride it out. The slowdown in oil and gas will hurt service providers which serve strictly that industry. In the end, we believe the industry is slowing down but it will come back.

Howe: Even though the headlines haven’t been particularly good lately, this area has been particularly good for us. Our product is used predominantly in oil and gas production to establish well sites, actively get the oil out of the wells. The headlines we’re seeing have more to do with the drilling side, companies laying off thousands of people, idle drill counts. The reality is that the production side is still very strong, we still see that supply is increasing month on month; the production side of the business is alive and well. Our natural gas generator lines play very well into that because in difficult times, even production sites are looking to improve operational efficiency and cut costs where they can. Natural gas generators that can run on wellhead gas that would otherwise be wasted offer a huge operating expense decrease versus having to pay for diesel fuel delivery to a remote well site.

Rental: What type of machines and services are in the greatest demand? By whom?

Howe: Most rental companies have a couple of Swiss army knives in their tool kit and it’s the G25 and the G70 class. Those are very popular fleet machines and can be deployed across many different applications without a lot of reconfiguration or special requirements. The G25 is a great machine for construction jobsite applications; small but very portable on the jobsite. The G70 is the next evolution of that for the same types of jobs but on a larger scale. From there, it varies all over the place, depending on particular market requirements.

Kocik: There appears to be a growing demand for alternative fuel and non-diesel powered generators, especially in the oil and gas segment. We’ve also seen a growing demand for containerized rental generator sets above 1000kW.

Andrea Stone, Kinsley Power Systes, East Granby, CT: We’re seeing demand for 100kWs, which are small and easily portable, and also 1mg units that can back up an entire building. There’s been a shift certainly in the Northeast after all the major weather events of the past couple of years. Businesses and buildings are doing full-scale building and facility backup instead of just life safety backup. It’s really shifted the size requirements that people are looking for in generators.

Crandall: That’s pretty prevalent here too. If there’s going to a be a long-term outage expected - anything longer than 1-2 days - customers will actually bring in larger units to power their entire facility, even though they already have a small, permanently installed generator on site. The smaller machines traditionally are only capable of powering the critical loads and won’t necessarily allow the customer to continue operating at full capacity.

Dolan: Demands for machines and services vary across sectors. The construction market necessitates smaller, more compact, reliable units, while the oil and gas market requires additional products and services because of the need for consistent power 24 hours a day, 365 days a year. The machines that the oil and gas segment requires are diesel and gaseous generators, light towers, heaters and pumps.

We have seen strong interest in gaseous-fueled mobile power generators. Oil and gas production companies have shown an interest in reducing the amount of flaring done in the field, and gaseous-fueled generators economically maximize field gas that would otherwise be flared off.

Rental: What can equipment rental businesses do to best serve the need for mobile power?

Stone: We have an emergency response team which is comprised of our rental department and our service department. We start notifying key customers days in advance of expected weather events and tell them the what’s happening and ask them what they want and where they want it. We try to be as fully deployed as possible ahead of the weather. You need to be rental ready all the time.

Crandall: Not only do you need to have the fleet but you need the fleet to be fully ready to go via a quality maintenance program. Servicing of the fleet is a major priority for all rental companies. During emergencies, you’re pretty much guaranteed the machine is going to be deployed quickly and running 24/7. Whereas in the industrial world, most of the time a machine is either in a standby application or running 6-10 hours a day on average if it is not a full planned outage. You really need to have a good service team in place to ensure all equipment is “rent ready.”

Kocik: Rental businesses can serve this growing demand by offering a complete range of EPA MOH certified products for diesel, natural gas, propane and nonstandard gas for oil field flare gas. To meet larger power demands, rental businesses can integrate their fleets with units that are capable of simple paralleling and varying load functionalities. Rental businesses can also serve the growing demand for containerized units by offering complete, turn-key power solutions from pre to post sale.

Dolan: Rental businesses need to offer a breadth of products and rapid 24/7 response service to meet the evolving demands of the mobile power market. They need products to be available on short notice and for these products to be configured to fit the customer’s application.

Rental businesses also should make sure team members are trained in sales and technical service so they can fully support their customers. For example, many oil and gas production companies are still not aware of the advantages of new gaseous-fueled mobile power generators. This is an area where equipment rental companies can help educate their customers.

Howe: It comes down to a rental company understanding what their customer’s need is. You really need to understand what they’re doing with the product and what their application is in order to give them the best possible solution. You want to make sure you’re sizing your customer’s need to the right piece of equipment, particularly in the Tier 4 world. If you give a customer a 100 kW generator and he only needs a 20 kW, you’re not providing him value because you’re overcharging him for a much larger machine than he needs, and you’re dramatically underloading your 100 kW machine, which is going to cost you down the road in the form of extra maintenance.

Rental: Where do you see the market headed in the coming year or two?

Dolan: Specific end markets will see new products that offer more reliability and are easier to service with longer intervals between preventive maintenance. For example, our MLT6S light tower with Mitsubishi engine extends service intervals from a standard 250 hours to an industry-leading 750 hours. This can save rental companies thousands of dollars in maintenance over the life of the product. These new products help the rental company with utilization and lowering operating costs, which helps profitability for both the rental company and end user.

In addition, there will be a focus on providing larger power nodes through paralleling multiple units. Customers also are seeking more turnkey solutions to various issues, including power distribution and site set up.

Finally, we see the interest in gaseous generators continuing to grow. They make economic sense and are more environmentally friendly due to the more favorable emissions profile of natural gas versus other fuel types. It’s a win-win-win for equipment providers, rental companies and production companies.

Kocik: It will be interesting to watch the market in the coming years with the introduction of new products, additional regulatory pressures and alternative technologies to reduce overall costs for rental businesses.

Howe: I think it’s going to be healthy. The rental industry came out of its normal cycle as companies tried to get a hold of as much pre-Tier 4 product as they could. That changed the normal buying behavior of the big nationals which are the companies that really drive the shape of the curves that affect this industry. That said, this year is probably pretty flat but next year and 2017 we’re predicting to be up. All the macro indicators that would drive rental business are going to be healthy. There’s infrastructure spending going on, as well as commercial and residential building. All things point to continued investment, which points to continued need for rental equipment and expanded power.